Protein Markets

- US soybeans are down 3% in conditions to 66% good to excellent from last week including a 2% drop in poor/uber poor conditions with ongoing dry weather through the mid-west

- Estimates have pegged the shortage of soil top moisture to be at 70% through the Midwest which will impact the US soybean pod filling and ultimately yields

- Canada has added nearly a million tonnes of Canola to last year’s crop at 19.5MMT vs 18.65MMT and 2020/21 crop forecast at 19.4MMT

- US Congress is pushing for a increase the ethanol exports to boost ethanol/DDGS production asking for an end to the 20% tariff on trade with Brazil

- The Parana river levels in Argentina are beginning to return to normal with large discharges of water from the Itaipu and Yacyreta dams but continued dryness still threatens ship movements

- Brazilian soy exports for the first three weeks of August have dropped by 19% as Brazil origin beans becoming a less attractive price to US origin and bottlenecks at Brazil ports slowing the export pace

PKE Markets

- Indonesia have yet to announce an increase in the export levy for palm products widely anticipated to be an additional $5USD/T

- Exports of palm oil from Malaysia are expected be between 13-15% down from July with the market expecting August production to also slide

Grains Markets

- US corn conditions are 62% good to excellent down 2% from last with dryness through Iowa now expected to prevent a record corn crop predicted early last month

- The International Grains Council is now forecasting the US corn crop for 2020/21 at 384.2MMT 2.6MMT shy of the record in 2016/17

- China has reportedly sold 51.5MMT of state reserved corn to ease the burden on rising domestic prices and support feeding for a rebuild in pork production

- Nearly 2 Million acres of wheat were covered in a late season frost in Argentina with the impact to yields relatively unknown at this stage

- Victoria received just over average rainfall for August with all districts now at or above average YTD rainfall with grain crops now forecast north of 8MMT

- Limited rainfall over Western Australia the second half of August has crops starting to show signs of distress with all growing regions now just below long term average rainfall

- Maize fields are being readied with Waikato growers spraying out ahead of early plantings later this month but with mild and dry winter conditions likely to aid preparations

Currency

- The New Zealand Dollar opened at yearlong highs this week at 67.7 US cents with broad weakness in the US Dollar

- Federal Chair Powell has indicated a shift in monetary policy will be needed in response to the ongoing economic climate from COVID-19 including it will be unlikely for US rates to increase in the near term

Dairy Markets

- NIWA has issued an alert for a La Nina which now stands at 57% likely bringing drier than normal conditions to South Canterbury, Otago and Southland

- Last night’s GDT auction showed a further 1.0% slide in prices overall including -2.0% to whole milk powder, +1.8% to skim milk powder and -1.2% to butter prices

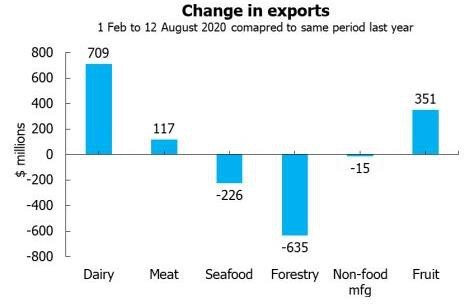

- New Zealand has exported $709 million more dairy products YTD compared to the same time last year reflecting strong dairy prices and growing demand in China