Protein Markets

- US soybeans are unchanged in conditions at 62% good to excellent from last week with plants now 50% at the leaf drop stage vs 37% last week

- Brazil is rumored to have bought 70,000T of Argentine soy oil to meet domestic biodiesel demands despite trade talks between the US and Brazil for ethanol tariffs lifting

- US Soybean harvest is underway at 6% complete mainly in the southern regions of the soy belt with yields so far exceeding expectations

- Argentina’s dollar trading restrictions are causing havoc for importers of fertilizers and farmers are considering switching to corn vs late planted soybeans if dryness persists

- India has announced 19.7M hectares of oilseeds have been planted including soybeans, canola and mustard seed vs 17.8M hectares last year as the country aims to become self-sufficient in oilseeds

- President Trump has proposed a $300m aid package to oil refiners that are denied exemptions to biofuel blending laws further squeezing ethanol/DDGS producers margins

PKE Markets

- Indonesia B30 program is expected to increase domestic consumption of palm by 1.2% according to the national palm associations GAPKI

- Malaysian Palm Oil exports have risen 9.4% for 1-20 September compared to August with strong crush margins providing incentives for producers to continue processing fresh fruit

Grains Markets

- US corn conditions are 60% good to excellent down 1% from last week with early areas underway with harvest at 8% complete nation wide

- Argentina has now seeded 14% of the 6.2M hectares of maize, down 100,000 hectares from last year but currency concerns could see a late switch to boost plantings

- French maize has been downgraded 1% in conditions to 59% good to excellent with harvest underway at 4%

- US winter wheat is now 20% planted vs 10% last week but the fallout from tropical storm Beta is likely to slow progress in the coming week

- The Buenos Aires Grain Exchange has lowered their wheat crop rating 8% to 15% good to excellent after the extended drought with production estimates likely to follow ratings down

- Rains over South Australia have boosted hopes for a harvest expected to start in the early areas over the next two weeks

- Victoria is facing an outbreak of Avian Influenza where an estimated 460,000 birds have been culled since the outbreak was first detected in July

- Domestic malt barley cropping area for the 2021 harvest is expected to be down due to reduced demand from the malting/brewers from Covid-19 and a hit to the hospitality sector

Currency

- The New Zealand Dollar opened at higher this week at 67.7 US cents with the market anticipating a sharper decline in GDP than reported

- New Zealand posted its worst quarterly GDP drop in history at 12.2% for the quarter ending June reflecting months of nationwide lockdown and seen as a “wake up call” for the world economy

- The RBNZ is expected to meet later today to make an announcement into monetary policy however the surprise GDP result is likely to dismiss further Covd-19 relief measures

Dairy Markets

- The Final milk payout by Fonterra was announced as $7.14/kgMS and shareholders will receive a final dividend of 5c per share ending the suspension of payouts in 2019

- Fonterra has posted a bumper annual profit of NZ $659 million to the year ending July after losses of NZ $605 million the previous year

- Key to Fonterra’s dramatic turnaround in results was reducing debt by $1.1 billion through sales of offshore assets in China, South America and other joint ventures

- The Government has announced a new 12 month visa allowing migrants skilled in the dairy industry to enter the country from October

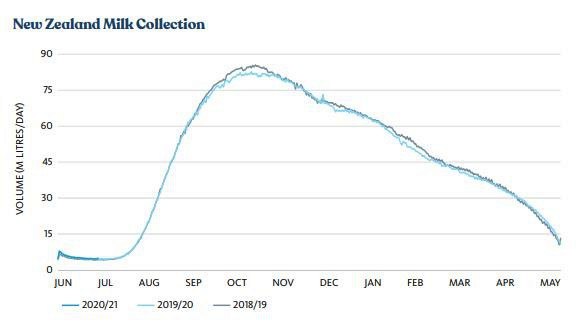

- August milk collections were up 4.7% compared to last year and the season to date up 4.5%

Source: Fonterra