Protein Markets

- US soybeans have improved in conditions up 1% to 64% good to excellent from last week with harvest now at 20% complete vs 6% last week

- Early yield reports for the US soybeans show above expectations for the Dakotas, Minnesota, Indiana, Missouri and well below expectations for Iowa with overall yields sub 2018 levels at 50.6 bpa

- US soybeans are also reportedly coming in very low in moisture at 8-9% with ideal range 13-15% causing brittle beans to break apart during harvesting and lowering yield

- China imported 9.6MMT of soybeans in August up 22% from last year with a whopping 8.1MMT from Brazil

- Brazil has reportedly imported 70,000T of soy oil from neighboring Argentina to meet bio fuel demands and talks of Brazil importing Uruguayan beans due to lack of domestic availability

- Brazil has begun early plantings of soybeans at 1% complete vs 3% on average with total area expected to expand by 3%

- Argentina’s sunflower planting has progressed to 17% complete aided by fine planting weather

- Argentina has crushed a total of 25.9MT of soybeans to the end of August, 9% lower than last year as Covid-19 halts production for weeks at two major crushing facilities

PKE Markets

- The Malaysian Palm Oil Association has estimated output for palm in the first 20 days of September has increased by 5%

- A La Nina event is edging closer to reality with estimates now saying a 70% chance and US NOAA has already declared a La Nina which typically brings floods and harvest delays to Indonesian and Malaysian palm fields

Grains Markets

- US corn conditions are 61% good to excellent unchanged from last week with harvest at 15% complete nationwide vs 10% average

- US corn yields are mixed but not as low as initially forecasted except for Iowa, similarly to soybeans which are well below expectations

- French corn is now 15% harvested vs 4% last week with another 1% drop in conditions to 58% good to excellent

- The Canadian wheat crop is almost complete with less than 10% expected remaining for harvest and a total wheat crop estimated at 34.1MMT down 0.76MT from estimates in August

- Further losses are expected to the Argentine wheat crop where estimates have 60% of the crop in average to very dry conditions up 10% from last week but rains coming this week are expected to bring some relief

- Russian wheat plantings have surged to 60% complete with the wheat areas dry and desperately seeking moisture to avoid crop losses and replanting

- A thick blanket of snow has fallen across South Australia’s Mid North for the first time ever causing concerns for frost damage to crops only weeks before harvest is set to begin

- Early maize plantings across the North Island are just underway with sporadic heavy falls over the weekend unlikely to delay plantings

Currency

- The New Zealand Dollar opened nearly 2 US cents lower this weeks at 65.5US cents reaching 18 month highs last week after the RBNZ left negative interest rates on the table

- The RBNZ kept interest rates on hold at Wednesdays meeting but signalled to banks they should prepare to cut interest rates even without an official cash rate change through low cost funding

- RBNZ’s Monetary Policy Committee directed the central bank to get ready to deploy the Funding for Lending Program (FLP) designed to provide low cost long term lending options ultimately lowering interest rates

- The FLP program would offer loans close to the official cash rate currently at 0.25% vs traditional borrowing services with a mix of transactional deposits (near 0% interest), term deposits (1.2% interest) and wholesale funds (1% interest)

Dairy Markets

- RaboBank has lifted its forecast for the dairy payout in the 2020/2021 season by 40 cents to $6.35/kgMS but noted Chinese dairy demand remained the biggest unknown post Covid-19

- RaboBank forecasts dairy production to increase in Q4 of 2020 by 1.3% for the major dairy exporters and a further 1.0% in the first half of 2021

- A recent change to the immigration law is expected to boost recruiting migrant staff to access skilled 3 year visas with Dairy NZ estimating a shortage of 1500 workers in the industry

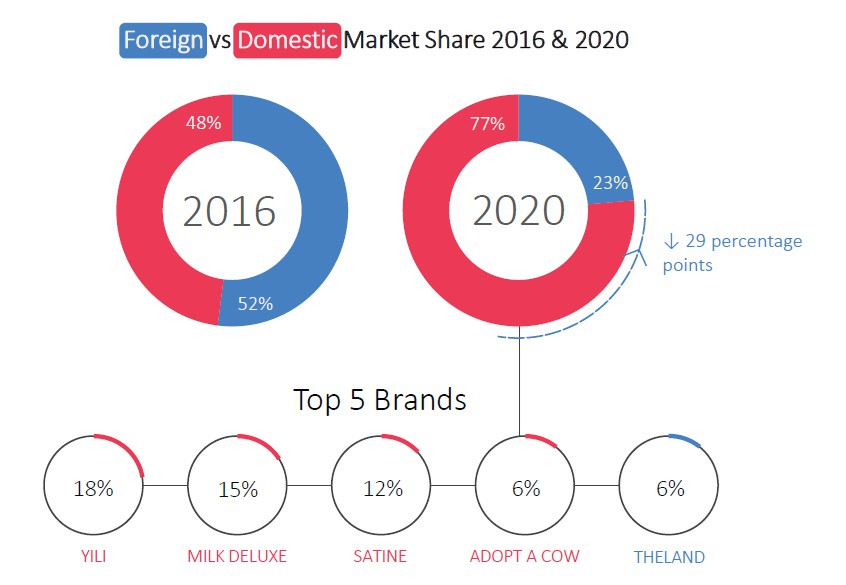

- Foreign dairy brands are losing market share in the Chinese market according to recent data with a rising sense of nationalism and loyalty to Chinese brands

Source: China Skinny