Protein Markets

- US soybean harvest is now at 96% vs 92% harvested practically complete in all areas

- The US Department of Agriculture released the latest supply and demand estimates (WASDE) lowering soy harvest estimates to 4.17bn bu (113MMT) down 2.34% from last month

- Brazilian soybean crop is still forecast to hit a record 134.95MMT up 8.1% year on year despite the late start to plantings at 70% complete vs 69% on average

- The Brazilian soybean belt is still dry with large parts receiving 50% or less of the average rainfall since August threatening yields forecast at 3.5MT/ha

- Argentina soybean plantings are now at 20% complete in line with last year with rains on the forecast this week expected to bring some relief to dry fields with harvest forecast at 49.5MMT

- A Port strike over a pay dispute has left 5 ships unloaded up river in Argentina likely to have flow on effects for vessel arriving over the next few weeks

- China has estimated the pig herd has grown by 27% from October a year ago fuelling an insatiable demand for protein based feeds into China

- The Australian canola crop is forecast at 3.34MT thanks to late season rains boosting yields in Western Australia up 13% from last month

- Ethanol/DDGs production was the highest since the beginning of the pandemic in March up 1.7% on last week but still 5.1% down on the same week last year

PKE Markets

- Indonesian palm oil body GAPKI has estimated year on year palm oil production to the end of September was down 4.7% with a similar amount expected for PKE

- GAPKI also said September production of palm oil was up 19.0% from August showing signs production has recovered with a similar amount expected for PKE

- Malaysian plantations will find some relief of critical labour shortages this week with newly passed laws enabling the hiring of overseas workers which was suspended in June

Grains Markets

- US corn harvest is now 95% complete vs 91% last week with farmers in clean up mode to get the remainder of the crop in

- Argentine corn plantings are unchanged from last week at 31% complete down 13% from last year as growers wait until December to plant the second crop

- Argentine wheat harvest is now 16% complete vs 14% this time last year where estimates have fallen to 16.7MMT down from 17MMT last month due the ongoing drought

- Western Australia has upgraded wheat forecasts to 7.9MMT up 6.8% from last month thanks to late season rains boosting yields

- The total Australia crop has been forecast at 32.3MMT with record yields being seen in Northern New South Wales after one of the wettest months of October on record

Currency

- The NZD opened the week at 68.5 US cents after trading above 69 US cents briefly last week with the RBNZ holding rates at 0.25% and a notable shift in sentiment on urgency of negative rates

- Prime Minister Jacinda Arden’s government signed the Regional Comprehensive Economic Partnership (RCEP) on Sunday the world’s largest free trade agreement worth an estimated $2 billion NZD for the local economy

- New Zealand’s median house prices has jumped 20% in the last year to $725,000 despite widespread predictions prices would soften in the wake of the ongoing pandemic

Dairy Markets

- The newly signed RCEP agreement leaves the door open for India to join after initially citing concerns for domestic dairy production and being flooded by New Zealand products instead

- Synlait Milk is seeking to raise $200m including a $20m share purchase plan to secure and prepare for a new manufacturing agreement with an unknown multinational customer

- Under the $200m target $70m of capital expenditure is expected to be allocated to manufacturing sites for blending and packaging

- Yili has appointed Richard Wyeth, former CEO of Miraka Milk as the new CEO of Westland Dairy

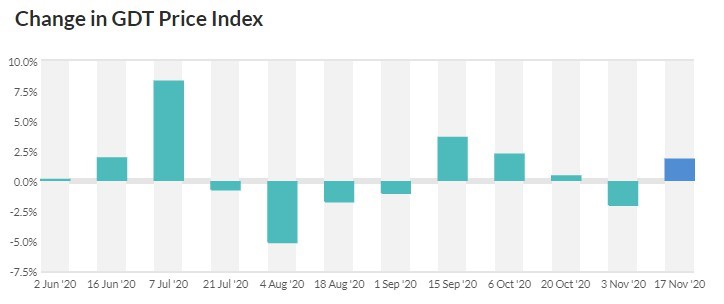

- Last nights Global Dairy Trade Auction results show prices were up 1.8% last night with milk powder up 1.8%, skim milk powder up 2.5%, butter up 0.4% and cheddar down 3.5%