Protein Markets

- Last week’s USDA report threw up a number of planting intention surprises. The soy planting number at 87.6 million acres was over 2 million acres lower than the average trade guess. Markets moved up limit on the Wednesday post report before giving back half of the gains over the next two nights.

- US soybean planting has started slower than usual due to wet weather across the delta.

- Strategie grains estimated new season canola production in the EU at 16.8MMT, vs 17.1 previous estimate and 16.3MMT last year.

- Brazil Soybean port loadings in March estimated at 14.8 MMT. April shipments to date are seen at 1.9 MMT with the line-up reported at 14 MMT.

- Rains forecast across much of the US with above average temperatures (Chicago was 32C yesterday).

PKE Markets

- Light rainfall was widespread across Southeast Asia last week. The lighter rainfall caused soil moisture to decline in central Sumatra, western Malay Peninsula, far southern East Malaysia, and western Kalimantan. The dryness in these areas will lead to minor stress on the palm crop. Similar conditions are expected across Southeast Asia over the next 7 days.

- Palm markets remain tight nearby with capacity/production booked out to May/June.The slower than normal summer demand means shipments to NZ are down on normal for this time of year.

Grains Markets

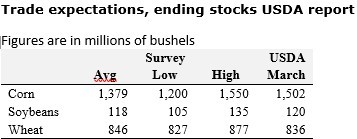

- USDA corn area planting intentions were 91.1M acres vs avg trade guess 92M acres and 2020 @ 90.8M acres.

- The Buenos Aires Exchange said that the corn harvest is 7.9% complete so far vs 22% this time last year.

- Russian Ministry of Agriculture has begun testing the mechanism for calculating grain price indices dut

y from 2 June. The levy will be 70% of the difference between the price and the base price (calculated by Russia’s National Mercantile Exchange (NME)) at $200/t for wheat and $185/t for barley and corn

- Recent flooding across Eastern Australia has seen crop prospects for coming season in NSW lift dramatically with the ideal soil moisture profile and current carry out setting east coast.

- North Island maize harvest proper is now underway, with the dry weekend across the north island dryers expected to be near capacity this week. Yields ex Northland/Auckland region have been on the disappointing side so far.

- Maize silage came in strong with above average yields seen across the country.

- South island grain remains highly illiquid; growers are willing to wait for the next dairy season at current price levels.

Currency / Political

- NZD/USD currently trading at 0.706.

- NZD has strengthened back above 0.70 post the dip on housing announcement. The tourism industry is hoping for some relief with the announcement of Australia/NZ travel bubble.

- Global prospects continue to look up with vaccine rollouts and stimulus packages globally continuing to add money to the system.

- Freight markets starting to soften across some trade lanes, giving up 5-10% of recent gains.

- May WTI crude oil closed up 0.79% to finish at $61.45 a barrel

Dairy Markets

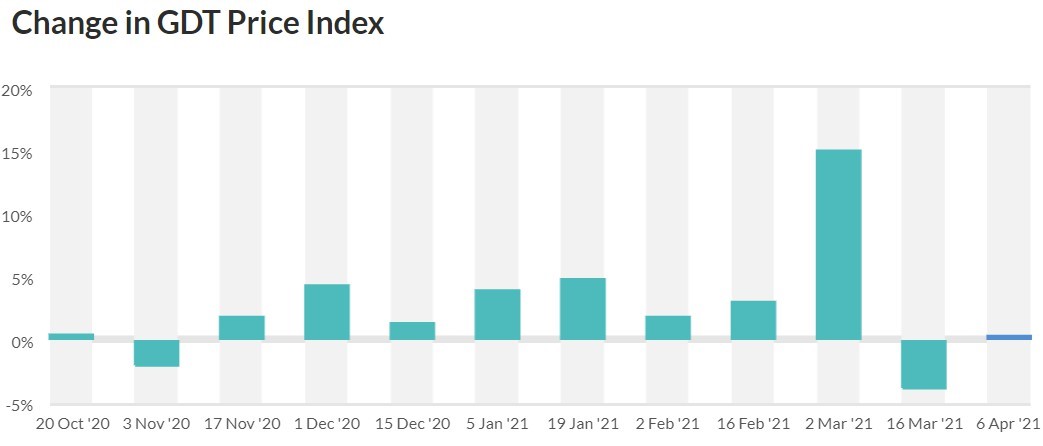

- GDT was more or less flat with the index up 0.3% and WMP flat.

- NZ MKP for 20/21 season currently $7.64/kg/ms.

- NZ MKP for 21/22 season currently $7.35/kg/ms.

- NZ WMP inverse has eroded slightly currently trading at a USD400/mt premium in the nearby vs new seasons.

y from 2 June. The levy will be 70% of the difference between the price and the base price (calculated by Russia’s National Mercantile Exchange (NME)) at $200/t for wheat and $185/t for barley and corn

y from 2 June. The levy will be 70% of the difference between the price and the base price (calculated by Russia’s National Mercantile Exchange (NME)) at $200/t for wheat and $185/t for barley and corn