Protein Markets

- Soybeans had their first weekly decline since October.

- The DDGS/soymeal ratio currently sits at 0.49, above the average of 0.42.

- The DDGS/cash corn ratio is near 133% this week, up from the prior week and above the average of 109%.

- Some DDG feeders have been switching to higher grade #1 corn due to high relative values.

- Topsoil moisture has improved, but regular rain is needed in December with subsoil moisture still below average.

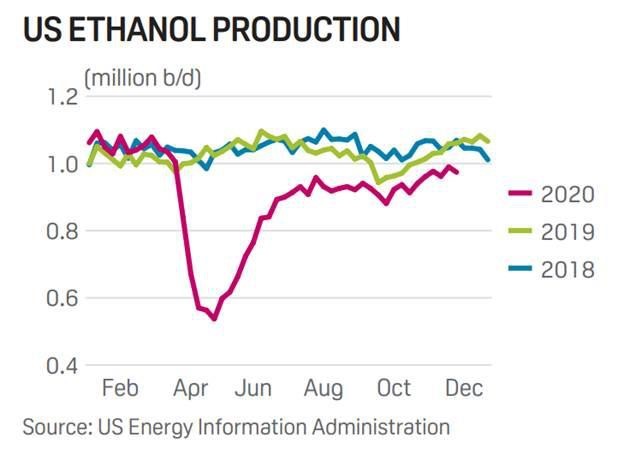

- Poor margins for ethanol producers has raised the probability of reduced output over the beginning of 2021.

PKE Markets

- Indonesia’s palm-oil production may climb to 42.5m tons from 41.5m.

- Palm oil prices have fallen from recent highs, which was the highest seen in 7 years.

- Indonesian export tariff on Palm Oil increased from USD55/MT to USD213/MT. PKE export tax/levy remains at USD30/MT.

- Malaysian Palm oil production down 9-15% across all regions through November.

Grains Markets

- Australian grain exports forecast to hit approx. 20MMT.

- Australian grain harvest is now 72% complete overall with wheat estimated at 65% and Barley 85% complete.

- Australian grain remains competitive vs other origins into much of Asia. Price spread between local and export prices continue to widen as capacity constrains the final export tonnage.

- Container shipments globally continue to come under pressure as GRI and peak season surcharges are adding $200-400/box to many trade lanes.

- Brazil first corn crop is now 80% planted this is 10% behind last year’s pace.

- Despite recent rainfall, Canterbury crops are still tracking a few weeks ahead of normal progress.

- The USDA stocks report is due out tomorrow. The average trade guess for corn sees a reduction in corn stocks globally and in the USA. Wheat expectations are largely unchanged vs last month’s report.

Currency / Political

- NZD continues to find new 30-month highs briefly touching 0.71 late last week.

- Rising COVID cases and near-capacity ICUs have also forced the state of California to extend its stay-at-home order until after Christmas.

- China halted Australian meat imports on Monday. No official reason given at this stage.

- Bunker prices up approx. $80 since the start of Nov.

Dairy Markets

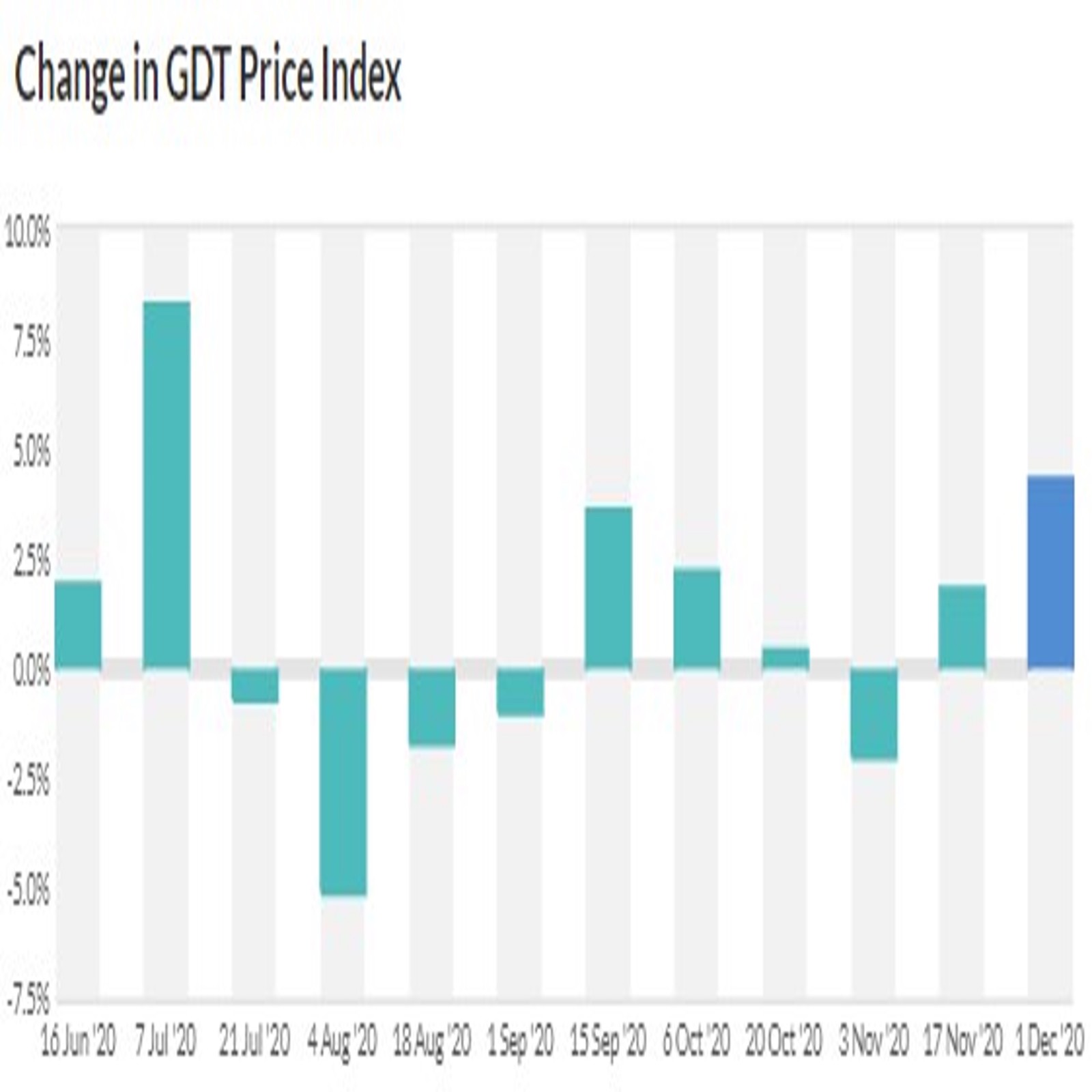

- NZX MKP futures remain firm currently trading at $7.11/kgms for the current milking season, which is the highest level for the contract since January.

- The dairy pasture growth index is now tracking at the upper end of seasonal range for the first time in 8 months.