Protein Markets

- US soybean harvest is now all but complete at 92% vs 87% last Monday as farmers try to get ahead of wet weather forecast for late this week

- Brazil has caught up in soybean plantings at 83% in Mato Grosso right on the 5 year average and nationwide at 56% vs 58% last year despite the extremely dry start to the season

- Brazil has announced it will allow the import of US GMO soybeans to fill crush demand expected to be 1MMT of beans that its struggling to source locally

- Argentina has just started soybean sowing at planted 4% vs 8% this time last year with dry sowing causing hesitation for farmers to get beans in the ground

- The Argentine sunflower crop is now 76% planted but face dry conditions with the potential for acres to go unsown without relief

- US DDGS/ethanol production continues to recover despite rising Covid-19 cases with exports in October the highest monthly total for 5 years at 1.16MMT

PKE Markets

- Malaysia has exempted all export taxes on palm products until the end of the year in effort to boost production and aid economic recovery

- Indonesia is expected to cut its biofuel blending mandate as the subsidy collected is expected to only fund 8MMT of oil vs 9.6MMT target

- The Malaysian Palm Oil Board has released October production numbers showing PKE was up 1.1% from September but overall production is down 3.8% from January to October

- Fresh fruit bunches production in Malaysia is also still below last year down 2.7% January to October with yields in October down from September by 9.1%

Grains Markets

- US corn harvest is now 91% complete vs 83% last week and farmers look to wrap up harvest in the next week to avoid looming storms

- Argentina has planted 31% of the corn crop vs 43% last year but normally suspend plantings in November as Northern/Central Argentina wraps up and Southern plantings begin in December

- Brazilian summer corn crop is 68% planted in the Central/Southern regions vs 62% last year

- US wheat plantings are 96% complete vs 89% last week with ideal conditions across the wheat belt will have plantings wrapped up this week

- China is rumoured to imposed an import tax on Australian wheat following on from barley earlier this year as the two nations continue in a diplomatic spat

- Australia has progressed to 25% complete harvest vs 14% this time last year with nearly 5MMT harvested in the last week with rain this week for Southern Australia expected to delay progress

- North Island maize crops are benefiting from the rain this week with crops showing signs of stress after dry sowing and limited rainfall

Currency

- The NZD opened the week at 67.9 US cents with a looming Biden win in the US Presidential election the global economy has strengthened

- Prime Minister Jacinda Ardern has sworn in her new Cabinet on Friday in what has been dubbed the largest majority win for a party in New Zealand since World War II

- Early results from US pharmaceutical company Pfizer shows a Covid-19 vaccine is 90% effective but warned commercial production is unlikely to begin before the end of the year

Dairy Markets

- Fonterra noted at the Annual Meeting that higher milk payouts will put pressure on earnings forecast but maintains a 20-35c per share payout

- Fonterra has also increased the mid-point of the milk payout for the 2020/2021 season to $6.8/kgMS with a range of +/- 50c citing resilient demand for milk powder despite challenges from Covid-19

- Keytone Dairy has signed a milk powder manufacturing and supply agreement with Kiwi national grocer Foodstuffs said to already have orders of $7.1M NZD

- Westpac has attributed last weeks dip in prices at the GDT down to Covid-19 noting overall volumes were down 8% compared to this time last year reflecting the slowdown in global trade

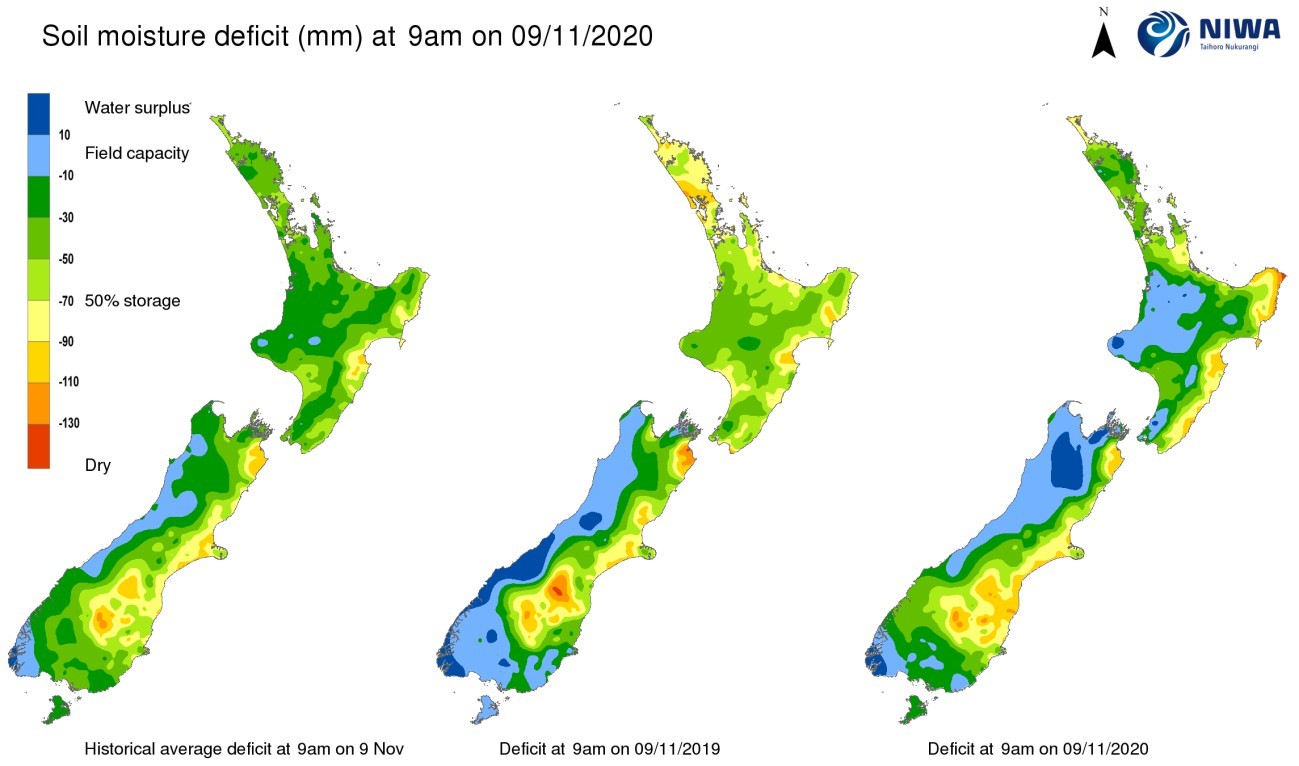

- Rainfall over the past week has brought soil moisture deficits to average to above average for all regions except isolated parts of Southern Canterbury and Lower North Island

Source: NIWA