Protein Markets

- US soybeans are now 75% podded vs 59% last week with conditions up 1% at 74% good to excellent as yields are set to challenge US records

- Iowa is set for heavy rains this week as soybean crops across the state need moisture with the rest of soybean belt in near ideal conditions

- Extremely dry conditions have sparked concerns for soybean plantings in Brazil expected to begin early next month

- Despite a record export program Brazil is expected to import soybeans from neighbouring countries including Paraguay to fill domestic crushing and biodiesel demand

- US June DDGS exports totalled 883,000T this year down 8% this time a year ago

- 160 kph winds have ripped through parts of the US Midwest causing power outages in ethanol/DDGs crush plants expected to be offline for the remainder of the week

- The US Soybean Export Council expects China to buy up to 30MMT of soybeans in the final 4 months of the year prior to new crop being harvested in Brazil from January

- Argentina exported 2.35MMT of soy meal in July vs 3.02MMT as historically low levels in the Parana river continue to cause headaches for vessels

PKE Markets

- The Malaysia-India trade dispute has been further fuelled after Former Prime Minister of Malaysia announced he would not apologise for comments over an Indian border dispute last year sparking a boycott of Malaysian palm products

- Malaysian PKE production was 246,309T in July marginally up by 0.4% from last month but remains 8.2% down YTD from last year

- July production in Sabah has been reported as up to 30% lower from June due to the impacts of flooding through late June/early July

Grains Markets

- US corn conditions are 71% good to excellent down 1% from last week with heavy rains in Iowa set to bolster conditions this week

- A Rabobank report has forecast China is set for a fifth straight year of reduced corn stocks with Chinese pork feeders substituting corn for wheat due high domestic prices

- The US winter wheat harvest is now 93% complete vs 85% last week and spring wheat has just got underway at 15% complete well behind the average at 25%

- The Argentine wheat crop is all but complete planted at 98% with conditions at 23% good to excellent with the extended dry weather causing concerns for the crop

- Brazilian corn crop harvest has slowed last week with rains in the southern areas slowing progress now at 64.6% complete vs 67.3% this time last year

- Decent rainfall for the Northern parts of the South Australian cropping belt have growers optimistic about yields after below average rainfall in June/July

- Old crop domestic barley is trading at parity with wheat with COVID-19 commodity price spike causing some substitution

Currency

- The New Zealand Dollar opened lower this week at 66 US cents after testing 67 US cents again but failing to break through

- RBNZ data shows inflation expectation for the third quarter rose modestly to 1.43% vs 1.24% last quarter

- Tensions between the US and China have been further fuelled as US President Trump announced all US residents will be banned from doing business with two Chinese social media platforms TikTok and WeChat

Dairy Markets

- Legislation passed amending the 20-year old Dairy Industry Restructuring Act has extended the rights of Fonterra to refuse milk from farms who don’t meet standards and some newly converted farms

- Rabobank’s August update has noted last weeks GDT results where prices dropped 5.1% reflected weakening demand from North-Asia down to 56% of the volume vs 62% two weeks prior

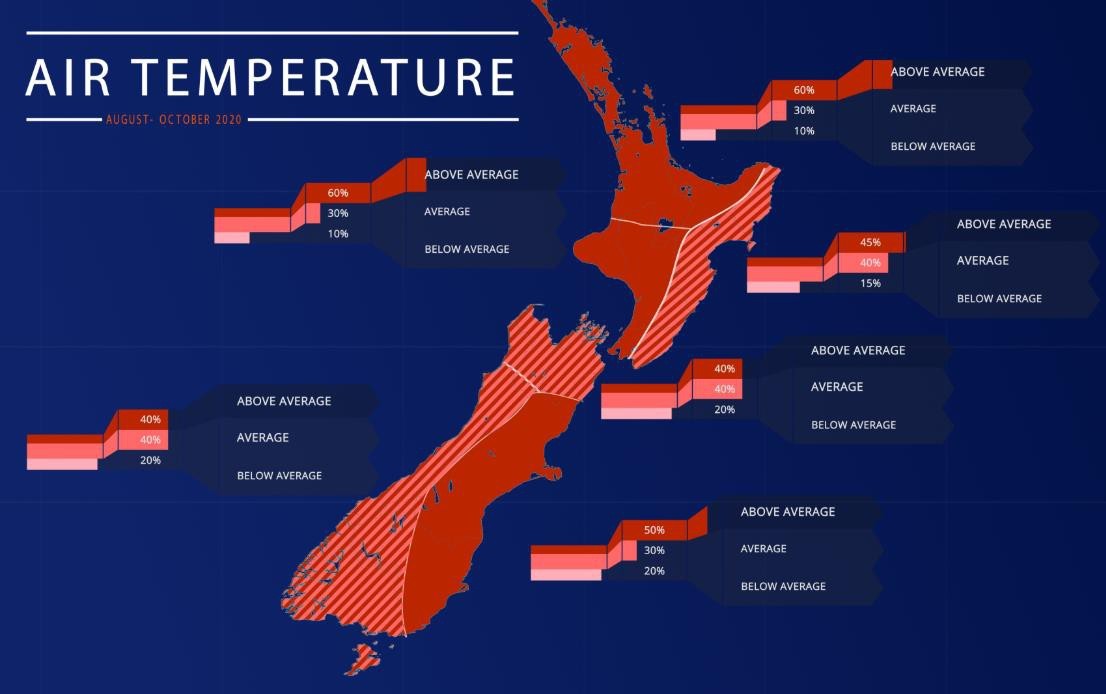

- New Zealand’s warm winter is set to continue into spring with at or above average temperatures expected for all regions