Protein Markets

- Soybeans top $16 for the first time since 2012.

- US Soybean planting is now 42% complete, vs 22% average.

- China bought two beans cargoes yesterday for July, one Argentine, one Brazil.

- WASDE report due out overnight with forecast carry out stocks/plantings. The average trade guess is less bullish then the last report.

- Brazil’s drought continues to reduce likelihood of any water being released down the Parana River to aid draft restrictions on up river vessel loading.

- China canola production forecast at 14.5MMT up 3% from last year.

- Australian canola prices continue to push near the $800/mt mark for next season.

PKE Markets

- Rains have been widespread across much of the palm belt over the last week helping improve soil moisture.

- Malaysia announces a month long lockdown to curb the latest covid outbreak. Whilst agriculture and shipping are deemed exempt activities logistical /harvest, disruptions are expected to continue to hamper nearby supplies.

- Local PKE markets remain tight as dairy farmers continue to feed late into the old season pushing prices back to recent highs.

Grains Markets

- US corn planting is now 67% complete, vs 52% average.

- Ukraine spring wheat and barley sowing is now complete however, maize and sunflower continues to lag normal pace.

- Investor participation in corn markets is at the highest levels seen since 1995, exceeding 2012 where the US had its worst drought in modern times.

- Brazil Safrina corn crop rated 30% bad.

- Good rainfall across the West Coast of Australia and eastern NSW continue to aid crops.

- Australian cereal crop approx. 30% sown. SA continues to lag normal progress due to dry conditions.

- Australian export capacity remains very tight with severe logistical delays across the east coast and available stocks in SA tightening due to fast export pace.

- NZ maize harvest now over 50% complete in the upper north. Rainfall this week may slow progress. Despite good yields there are very few tonnes remaining in farmer hands.

- AIMI report had NZ crop down 3% on last year. Unsold grain on farm has fallen by 25% compared to this time last year.

- NZ wheat demand remains high, 2022 interest is in strong demand with prices pushing higher in the last few weeks.

Currency / Political

- NZD/USD currently trading at 0.727.

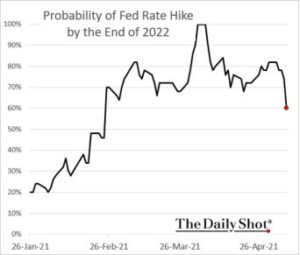

- Probability of fed rate hike slipped as US data comes in poorer than anticipated.

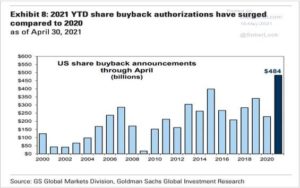

- With US reporting season coming to a close and record profit margins (for now), low yields and a view that holding cash is futile. Companies are returning to buying back their stock at record highs funded but cheap debt.

- Brent oil currently trading near USD68/barrel.

Dairy Markets

- NZ MKP for 20/21 season currently $7.70/kg/ms.

- NZ MKP for 21/22 season currently $7.72/kg/ms.

- NZ MKP for 22/23 season currently $6.81/kg/ms.

- Based on current nearby milk prices if they hold, dairy farmers could be looking a t$9/kg/ms next season.

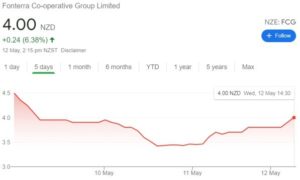

- Fonterra capital restructure looks to reduce farmer wet shareholding requirements from the current 1:1 ratio to 1:4.

- Fonterra share price has started to bounce back post sell after capital structure announcement.