Protein Markets

- Argentine strikes are over however the market will spend the rest of the season trying to play catch up from lost production and exports.

- Soybeans traded over six-year highs on fears that drought in Argentina will cut production at time when China’s demand is booming.

- USDA report saw Soybeans down half a bushel reduction in yield, which shaved another 35 million bushels of production off.

- South America has rain in the short-term forecast with showers in Southeast

- Argentina and much of Brazil’s cropping regions. The long-term weather forecast has also turned wetter for much of Argentina for the end of the month.

- DDG prices continue to surge on higher corn prices and feed demand in the US.

PKE Markets

- The market is closely looking at the mounting pressure on biodiesel mandates in both Indonesia and Malaysia. The Indonesian Palm Oil Association has urged the government to be more flexible on several aspects of the policy to ensure the program has a longer life. Malaysia plans to delay full implementation of its B20 blending mandate until 2022.

- Malaysia has implemented a second round of Movement Control Order restrictions despite this the Malaysian government assures that Palm Oil industrial operations will carry on as per normal.

- Palm oil futures tumbled the most since the middle of November on concerns about a big drop in exports from second-biggest grower Malaysia, and weaker consumption following another surge in coronavirus cases across the world.

Grains Markets

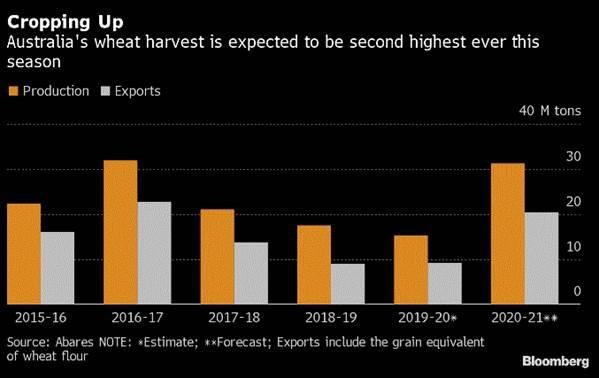

- Australian wheat crop is forecast to be the second largest ever. With global prices climbing farmers/Australian trade are the benefactors as market scrambles for export capacity and Australian wheat.

- China approved two genetically modified corn varieties from Bayer AG and Syngenta AG for imports as demand for animal feed surges. China allows imports of GMO crops for processing only and they cannot be used as seeds.

- Argentina, the world’s third-largest corn shipper, ended a temporary ban on exports. The government will instead enact a daily sales cap to ensure domestic supply.ts.

- The Chinese government released about 2Mt of wheat from its strategic reserves to supply its domestic market and try to curb prices’ inflation.

- USDA report saw a 15-year historically large cut in corn yield. Down 3.8 bpa to 172 bpa. The USADA also revised demand lower trying to balance the books, the market is disregarding the demand cuts at this stage.

- Russian export taxes continue to disturb trade lanes. Egypt buys most of its wheat from Russia however received only one offer of Russian grain at recent tender. This offer was well above prices for Romanian and French supplies.

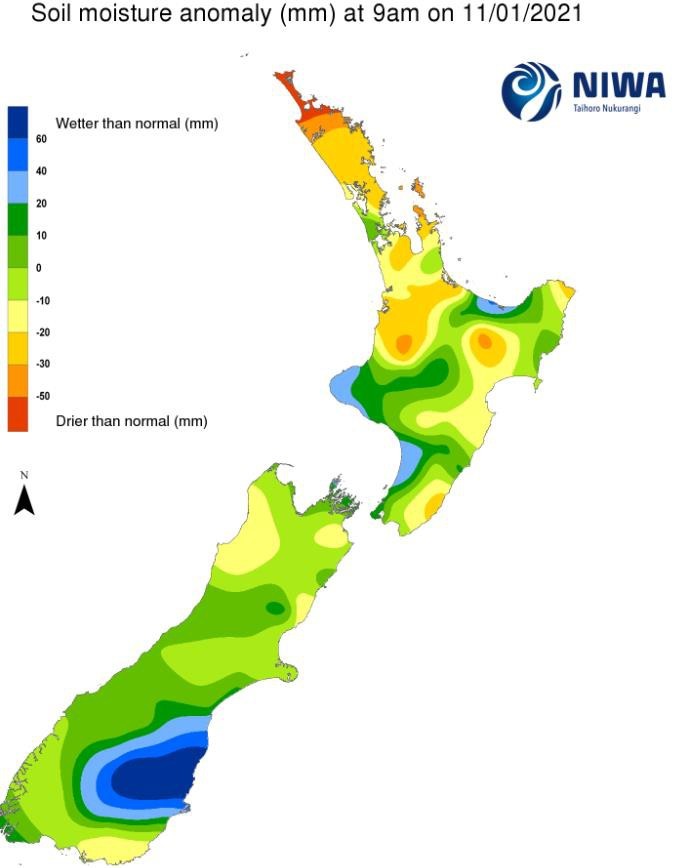

- Christmas rainfall through much of Canterbury slowed the early Barley harvest, significant progress has now been made during the last week.

- The hail event in Waimate/St Andrews regions in late Dec and early Jan has caused significant damage to Canola seed crops, which were almost ready for harvest. Wheat and Barley were also affected but not to the same degree.

- North Island rainfall has maize crops progressing well with many crops 2weeks ahead of progress.

Currency / Political

- NZD/USD has pulled back off recent highs currently trading at 0.717.

- Bunker prices continue to inch upward, after the recent news that Saudi is planning to cut their oil production by a million barrels a day in Feb 2021. Both Brent and WTI crude are trading well above the US$50 level since the announcement.

- US parliament continues to push forward for Donald Trump’s impeachment after the storming of the Capitol last week.

Dairy Markets

- NZ MKP for 20/21 season currently $7.05/kg/ms

- Last week’s GDT auction was the fourth positive result in a row. GDT up 3.9% overall and 3.1% WMP.

- Northland / Waikato and East coast tending dry. All other regions have received reasonable rainfall in recent weeks.