Protein Markets

- Brazil the No. 1-growing soybean nation will temporarily reduce the mandated diesel inclusion to contain 10% biodiesel down from1 3% previously.

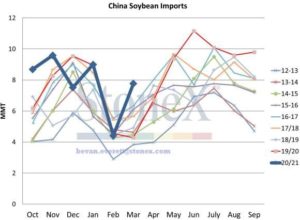

- Chinese Customs administration said the country imported 7.77mln tonnes of soybeans in January and have imported 47MMT YTD vs 41.8MMT last year.

- Chinese domestic pork prices are down 40% since the beginning, either they are liquidating herds due to ASF, or larger herd and market forces are dramatically affecting pricing.

- Most of the market expects the USDA to add 2million acres to both soybean and corn planting intentions.

- Soy oil stocks at 5yr low in China due to increased feeding of soyoil to balance energy requirements due to higher corn alternative inclusions.

- Below normal temperatures are also expected across the central U.S. over the next week, which will slow germination of corn and soybeans. Average soil temperatures expected to be below the threshold for supporting corn and soybean germination (55°F or 13°C) for the next 10 days.

PKE Markets

- The Malaysian Palm Oil Board called March palm oil production 1.42 mln tons, up 28%f rom February, and stocks 1.45 mln tons, up 11%, and versus the average trade guess of 1.32 mln tons.

- The Ag Attaché in Malaysia called old crop palm oil production 19.5mln tons for the country, and new crop 20 mln tons

Grains Markets

- Wheat futures have reversed recent rally on better global crop prospects with prospects improving in Russia.

- US corn crop now 4% planted, slightly ahead of average, US winter wheat ratings remain at a solid 53% good to excellent.

- Brazil’s largest poultry has recently bought corn from Argentina raising concerns on local supply.

- Chinese Customs administration listed the Q1 wheat imports at 2.9MMT up 131%

- Following recent rainfall on the east coast, this week has seen WA have their turn. Tropical cyclones have bought moisture across large areas of the grain belt.

- North Island maize harvest proper is now underway, wet weather is causing some delays with both harvest and dryer receival. Yields ex BOP look like they will be very strong offsetting some of the earlier poorer yielding crops.

- South island grain remains highly illiquid; growers continue to be happy to hold out until dairy demand in spring at current price levels.

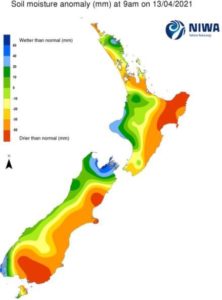

- Very dry conditions across Canterbury is delaying winter wheat and barley planting. Farmers are still drilling anyway which could lead to some possible emergence issues.

Currency / Political

- NZD/USD currently trading at 0.703.

- Global prospects continue to look up with vaccine rollouts and stimulus packages globally continuing to add money to the system.

- Dow Jones up 10% since the turn of the year.

- US inflation data for March came in higher than expected taking YOY increase to 2.6%.

Dairy Markets

- NZ MKP for 20/21 season currently $7.68/kg/ms.

- NZ MKP for 21/22 season currently $7.44/kg/ms.

- ZX/SGX have announced a partnership intended to increase market distribution and liquidity of dairy futures.

- WMP futures continue to rise in Q3 for mid- year pricing increasing prospects of improved payout next year.