Protein Markets

- US soybeans are down 2% in conditions to 63% good to excellent from last week with plants now 37% at the leaf drop stage vs 20% last week

- The USDA has pegged new crop soybean production in the US at 4.313 billion bushels (117.4MT) down on the August estimate of 4.425 billion bushels (120.4MT)

- The USDA also forecast soybean yields at 51.9 bpa vs 53.3 bpa acre last month reflecting some of the storm damage over the past month

- The USDA Farm Service Agency announced 1.45m acres of soybeans were prevented from planting vs 1.22m acres reported in July

- Brazilian soybean production is estimated at 131.3 MMT with planting area at 38.1M hectares up 3.25% from last year

- Strong forward sales to China have the Brazilian soy crop estimated to be 47% sold vs 25% this time last year

- The Ukrainian sunflower harvest is now 19% complete vs 7% last week with fine weather aiding harvest progress

- US President Trump has announced petrol stations in the US will be allowed to sell 15% ethanol blended fuel subject to individual state approvals in a bid to prop up production of ethanol and DDGS

PKE Markets

- Malaysia PKE production was down 3.5% in August from July to 238,000T with a 2.0% increase in Peninsular Malaysia and a decrease of 11.9% in East Malaysia

- Malaysian PKE production is now 5.8% lower from Jan-Aug this year vs last year in line with palm oil production down 4.7% for the same period

- Indonesia is laying out plans to revamp the export levy with an increase by $5 for every $25 in the reference price to finance the gap between production costs of palm based biodiesel and diesel from crude oil

Grains Markets

- US corn conditions are 60% good to excellent down 1% from last with dryness in the Southern corn belt dampening expectations for near record yields

- US Corn is now 5% harvested right on the 5 year average with dry areas in the South significantly lifting the average harvested percentage

- The Brazilian government has floated the idea of opening trade talks for free trade of soy, corn and ethanol with the US over the next 90 days as the country is expecting to import US soy to meet commitments

- Ukrainian corn yields are down 7% from their previous estimates with drought like conditions declared in Southern Ukraine

- US Spring wheat is now all but complete harvested at 92% vs 82% last week and winter wheat planted at 10% vs 5% last week

- Argentina had wide spread frost events in the wheat areas over the weekend but temperatures were not low enough to cause major damage and harvest has progressed to 8% complete

- The USDA has forecast a record wheat production for the world at 770MMT up 4.4MMT from the previous estimate including a 2.5MMT boost to Australia

- A series of typhoons have hit North East China causing local flooding and ripping corn crops from the ground with estimates of damages between 3-10MMT

- Hard border closures between South Australia and Victoria are likely to cause logistics nightmares for some growers looking to deliver into South Australian grain network

- Western Australia grain estimates have been trimmed 2.6% with early spring rainfall not enough to sustain crops with the potential to reduce yields by another 5-7% if without additional rainfall

- Local feed barley continues to be priced above feed wheat with supply for barley extremely tight until harvest begins late December

Currency

- The New Zealand Dollar opened at slightly lower this week at 67.0 US cents largely supported by upbeat sentiment from NZ Institute of Economic Research report into economic recovery post COVID-19

- A report released Monday by NZEIR shows the economy is likely to contract 7.2% in the year ending March 2021 followed by an expansion of 6.7% in 2022 showing more resilience than expected

- The NZEIR report also outlines expectations for unemployment to remain at 5.8% until 2023 and inflation on the lower end of the Reserve Bank’s target at 1-3%

Dairy Markets

- Fonterra has acquired Australian based Retail Food Group subsidiary dairy processing facility Dairy Country in Victoria

- The Commerce Commission has released the final report into Fonterra’s base milk price calculation for the 2019/2020 season with Commission deeming the calculation appropriate

- The Commerce Commission’s review this year focussed on Fonterra’s administrative and overhead costs revealing no areas of concern

- The Real Estate Institute of NZ has released statistics showing the price per hectare of dairy farms has dropped 29.1% to a median of $23,193 for in the three months to the end of July

- REINZ has noted only two sales of dairy farms in Canterbury during that period but falling dairy values reflect prices for those farms with high debt to equity levels and increasing compliance costs

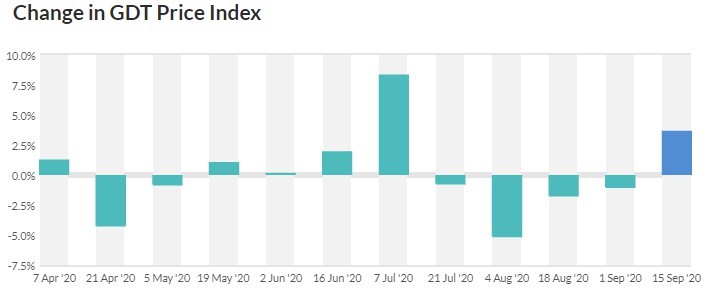

- Last night’s GDT results show prices were up overall 3.6% with gains to whole milk powder (3.2%), skim milk powder (8.4%), cheddar (7.2%) and a loss to butter (1.4%)

Source: Global Dairy Trade