Protein Markets

- Chinese crushers bought 6-7 cargoes of Brazilian beans to cover shortfalls due to the issues in the US Gulf, PNW supplies were already well sold across this period.

- Canadian canola crop forecast to fall to 12.78MMT vs 19.49MMT last year. Additional to the lower yield poor quality and low oil levels is causing significant issues.

- Rumors China has booked multiple cargoes from PNW post Hurricane Ida.

- China thought to be short 25% of October soybean requirement still.

- Soybeans rally significantly in the last 3 weeks due to India relaxation on GM stance and US logistics issues.

- U.S. NOPA (National Oilseed processor association) had August soybean processing fall to 158.8M Bushels vs 165.06m bushels last year. Soybean-oil inventories at the end of August 1.668, compared with 1.519b a year earlier.

- US corn / soybean price spreads conducive to larger US soybean planting next season.

PKE Markets

- Palm Kernel imports into NZ 1.2MMT Jan21-Aug21 vs 1.28MMT Jan20-Aug20.

- Malaysian Palm oil export expectations continue to show a surge on trade for the half of the month, with cargo inspectors estimating shipments for the September 1-15 period jump over 50% on the month respectively.

- India imported 750kmt of Palm oil in August due to advantageous pricing vs other oils.

Grains Markets

- Japan has issued a tender to purchase another 120kmt of wheat in December.

- Latest Canadian cereal crop estimates, Total wheat at 21.72MMT vs 35.18MMT last year. Barley

at 7.14MMT vs 10.74MMT last year.

- Russian wheat yields 2.9 tons/hectare, compared with 3.15 tons/hectare last year. Despite this USDA forecasts still expects the wheat crop to be 75MMT.

- Brazil winter corn sales already 70% complete up 5-10% on normal due to smaller crop.

- Australian crop currently going backwards due to recent dry weather across SA/WA and frosts in WA. Despite this crop still expected to be very large.

- Domestic maize ground work continues although recent wet may slow further progress, growers are in no rush to contract at this early stage.

- South Island grain remains highly illiquid although some signs of a few more barley parcels starting to come to market. At this stage there is more than enough pent up demand to consume these tons.

Currency / Political / Economic / Other

- NZD/USD trading at 0.709.

- Oil continues to make large gains with Brent Crude currently trading over $75/barrel.

- Lamb prices at record highs, currently trading at $9.30/kg.

- NZ GDP up 2.8% across Q2.

- NZ covid vaccine rollout up to 71% first dosed.

Dairy Markets

- NZ MKP for 20/21 season currently $7.61/kg/ms.

- NZ MKP for 21/22 season currently $8.09kg/ms.

- NZ MKP for 22/23 season currently $7.50/kg/ms.

- Singapore’s Olam confirms plan to build dairy plant in south Waikato.

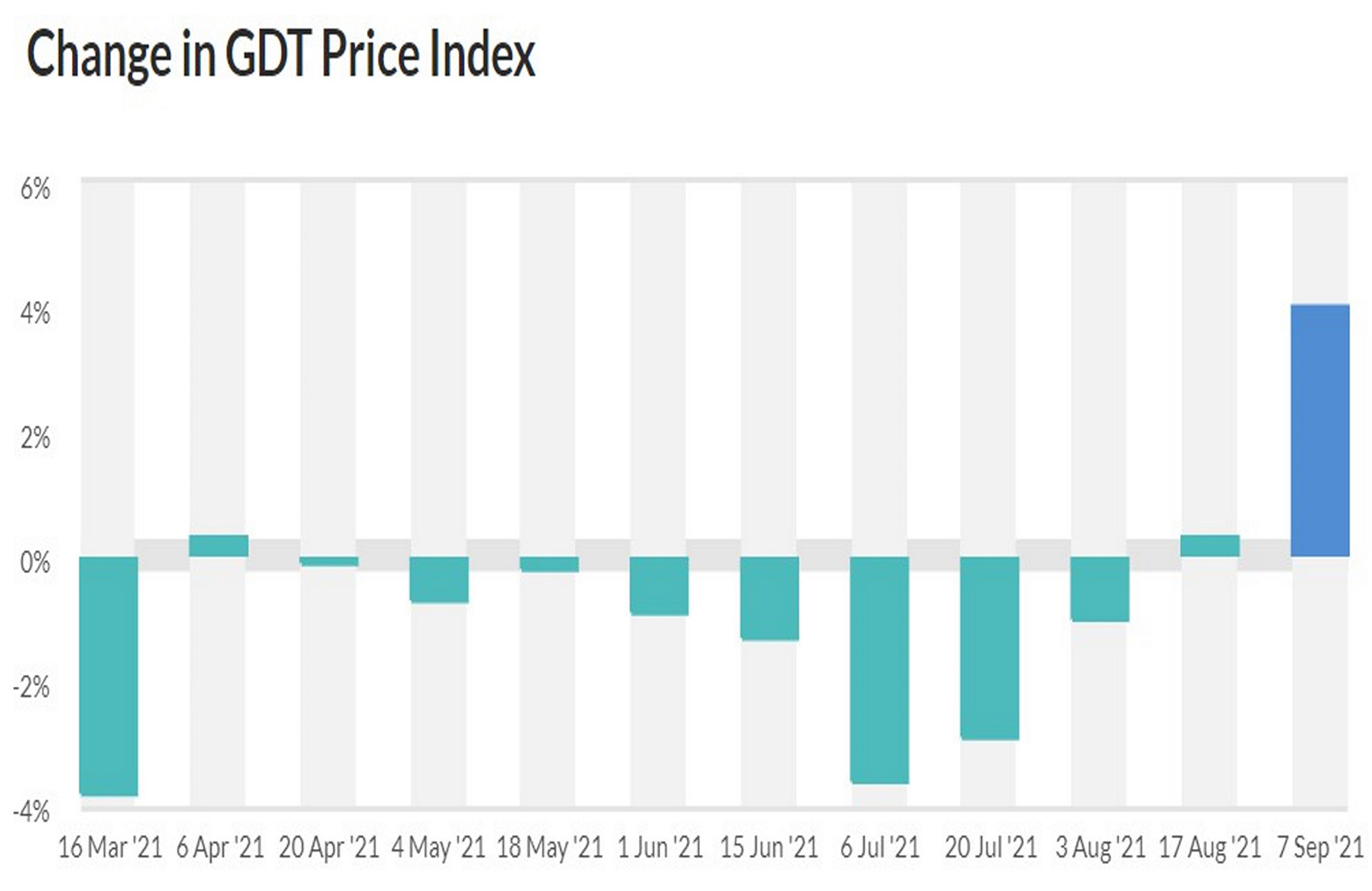

- GDT auction #291 last week was up 4% overall with WMP up 3.3%.

at 7.14MMT vs 10.74MMT last year.

at 7.14MMT vs 10.74MMT last year.