Protein Markets

- Sporadic rains through the Eastern US soybean belt have caused minor delays with harvest now 75% complete overall vs 61% last week

- The Brazilian government has confirmed the idea of cutting import taxes on soybeans by 8% to zero at the end of this year as the countries crushers struggle to get domestic beans

- Brazilian soybeans are approximately two weeks behind in plantings at 8% complete vs 17% average with extremely dry soils hampering progress

- Brazil is expected to replant early soybeans but local farmers are struggling to find beans to seed in the ground with a shortage of soybeans in between seasons

- Argentine soy plantings have progressed to 27% complete set to receive rains this week will also bring relief to parched soils

- Argentine Sunflower crop is now 27% planted with slow progress due to prolonged dry weather

- The US exported 1.02MMT of DDGS in August, down from last year at 1.15MMT and 1.08MMT in July

PKE Markets

- Malaysian fresh fruit bunch yields have recovered from the first half of the year to 12.73T/ha January to September 2.5% lower than this time last year vs 7.85T/ha January to June, 7.0% lower than last year

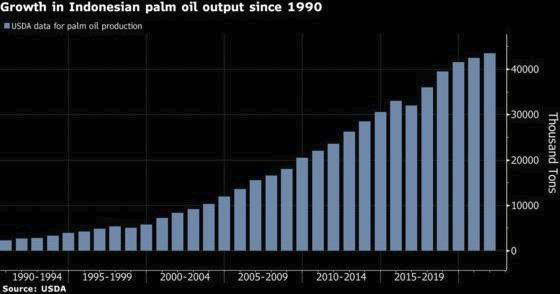

- Indonesian Palm Oil Association GAPKI is forecasting palm output next year to rise 4% to 49MMT of palm oil and test production records thanks to higher than average rainfall and fertiliser programs

Grains Markets

- US corn harvest is now 60% complete vs 41% last week with yields looking good in all states except Iowa and Nebraska which represents a third of US production where yields are well below average

- Brazil is expected to double corn ethanol/DDGs production in the next two years to 5.5 billion litres of ethanol

- Argentina corn plantings are now 23% complete vs 16% average with despite prolonged drought through the corn belt

- US winter wheat is now 77% complete planted vs 68% last Monday slightly ahead of the 5 year average at 72%

- Russia has now planted 84% of its winter wheat but suspected export quotas to be enforced in January has boats lining up at ports to export before the end of the year

- Argentine wheat harvest is just getting started in the very early areas at 1% complete and early yields averaging 1T/ha as drought hurts yields across the country

- Eastern and Southern Australia continues to get late season rainfall boosting yields in later harvest regions with harvest just underway in South Australia and Western Victoria

- Western Australia has missed out on much of the Spring rainfall where forecast estimates have been cut by 10% to 12.99MMT but cooler Spring temperatures have limited yield losses

- The recently introduced National Policy Statement for Freshwater Management has outlined new rules to limit synthetic nitrogen fertiliser application to 190kg/ha to pastoral land including forage crops but excluded arable crops including Maize

Currency

- The NZD opened the week at 66.1 US cents slightly down from last week with no surprises in the election result providing support to the Kiwi Dollar

- A surge in worldwide Covid-19 cases over the past week has increased caution on economic recovery and the International Monetary Fund issued a statement the global economy will contract 4.4% this year

- The IMF’s lending facility the World Bank has estimated an additional 114 million people will be cast into extreme poverty this year, living on less than $3 NZD per day

Dairy Markets

- Fonterra has increased the mid-point for the milk payout in 2020-21 to $6.8/kgMS up 40 cents citing a post Covid-19 demand increase from China

- South East Asia is expected to overtake China as the largest importer of dairy products by 2030 according to a forecast from RaboBank to 19 billion litres equivalent vs an estimate of 12.9 billion litres this year

- GDT results last night show prices were up overall 0.4% with gains to whole milk powder (0.3%), butter (3.3%), cheese (3.0%) and a loss to skim milk powder (0.2%)