Protein Markets

- Brazil soybean harvest now 91% complete with 6% harvested this week.

- China’s soybean crush margin collapses on worries over feed demand. The re- emergence of swine fever in some regions has seen some farmers slash herds slowing recovery. Pork imports through March hit an all-time record. Soybean/Rapeseed and Rice bran extract.

- Indian oilseed meals lifted 82% in March; this was predominantly made up of

- China is expected to import 103MMT of Soybeans this year up 2.2%.

- Despite Canada being the world’s #1 canola exporter they are reported to be importing a cargo of Ukrainian canola.

PKE Markets

- Palm kernel production remain low with the price inverse continuing to move further out as delays persist. Most crush plants are now fully committed until June with some struggling to meet existing commitments.

- Sabah region of Malaysia is back in lockdown until 30th April due to a significant spike in covid cases further limiting harvest/processing activity.

Grains Markets

- Chinas top corn growing province will offer higher subsidies to corn growers this year in an attempt to increase plantings.

- China sold less than 500k of the 5MMT available at recent sales.

- Freezing weather across the US could harm wheat crops and cause delays to the corn planting. If the cold continues, farmers may look to plant more soybeans, which tend to fare better in cold soils.

- Romania unexpectedly sold a cargo of wheat into France, which may halt wheat price rally in the Euro market.

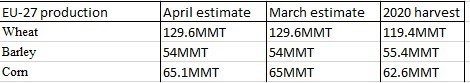

- EU cereal crop prospects remain strong with the wheat crop forecast to be 8% larger than last year.

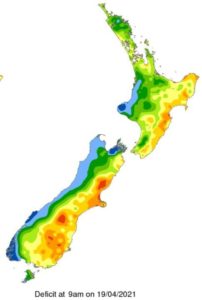

Despite recent rainfall, eastern regions of NZ remain very dry slowing pasture growth and crop development.

- Farmers throughout Canterbury are left with little choice but to continue planting autumn crops into dry soil. Whilst there has been some very light showers most Canterbury farms could do with an inch of rain to get things going.

- Maize harvest approximately 18% as progress continues to accelerate despite recent rainfall. Rainfall is causing some issues getting crop into/out of dryers.

Currency / Political

- NZD/USD currently trading at 0.717 off yesterday’s highs.

- Russia has stationed an estimated 150,000 troops on the Ukraine border raising prospects of regional unrest.

- Oil has broken out of recent technical downward trend. Prices continue to hover around $63/barrel.

- After recent movements lower, freight prices have found a new round of support starting to drift higher again.

- BNZ expects NZ headline inflation to be 1.4% YOY vs RBNZ 1.7% despite this sentiment is that core inflation is already at 2% or higher.

Dairy Markets

- NZ MKP for 20/21 season currently $7.64/kg/ms.

- NZ MKP for 21/22 season currently $7.42/kg/ms.

- GDT results overnight were relatively flat, index -0.1% and WMP +0.4%

Despite recent rainfall, eastern regions of NZ remain very dry slowing pasture growth and crop development.

Despite recent rainfall, eastern regions of NZ remain very dry slowing pasture growth and crop development.