Protein Markets

- Long delays at Chinese ports are slowing soybean imports to a near halt as authorities demand rigorous testing of imported goods for Coronavirus

- US soybean pods are now 25% set vs 11% last week and 21% with conditions gaining 1% to 69% good to excellent from last week

- Brazil is importing Paraguayan soy oil for the biodiesel sector as low crush rates and exceptionally low margins have starved domestic biodiesel production

- Brazilian new crop soybean plantings have been forecast up by 1.8% to 37.8M hectares with production at 131.7MMT up 5.4%

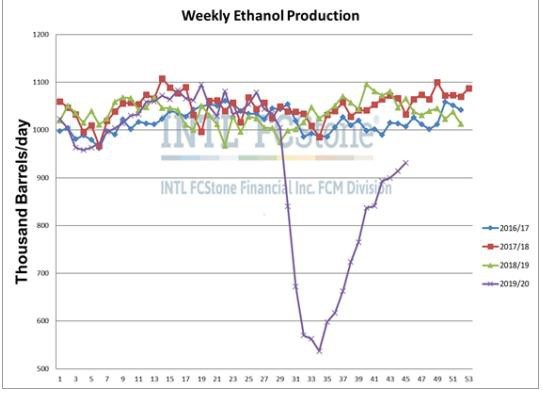

- Weekly ethanol & DDGS production continues to improve with ethanol up to 931,000 barrels per day but still down 135,000 barrels per day on last year and an estimated 12% year over year supply deficit

PKE Market

- After flooding in late June workers are beginning to return to plantations in Johor and Sarawak, Malaysia however effects on yields are yet to be realised

- The Malaysian Government has announced a freeze of recruitment for foreign workers at palm plantations which could cause significant harvesting delays as labour shortages are expected to worsen

Grains Markets

- US Corn is now 59% silking vs 29% last week blowing away trade expectations at 45% and conditions remain unchanged at 69% good to excellent

- Argentina is expected to plant 6.75M hectares of maize down 7% from last year reflecting the unseasonably dry weather particularly in the Northern part of the country

- Similarly wheat hectares have been cut in Argentina to an estimated 6.5M hectares which is 87% completed planting

- European wheat output is expected to decline 8.3% year on year to 142MMT 2020/21 with the lowest planted area in over a decade

- Dryness through Russia continues to hurt early wheat yields with production estimated down 1.1MMT to 76.5MMT

- Heavy rains across last week in Western Australia has provided relief to wheat crops showing early signs of stress

- Above average rains forecasted for August and a switch of acres from barley to wheat has pushed the Australian wheat crop estimates to 27MMT

- The latest AIMI report shows the New Zealand maize grain harvest was down 7% year on year

Currency

- The NZD has opened this week at 65.50 making no ground from last week with positive NZ manufacturing data but spiking Coronavirus cases in Australia and the US dampen gains

- Inflation data released last week shows New Zealand’s second quarter inflation was -0.5% the first quarterly fall since 2015 however year on year was up 1.5%

Dairy Markets

- Fonterra has lowered the milk price forecast for the current season by 5c to $7.10-$7.20 down from $7.10-$7.30 per kg/MS citing the strengthening New Zealand Dollar making exports less competitive

- Fonterra has lifted the bottom end of the 2020/2021 forecast to $5.90-$6.90 from $5.40-$6.90 per kg/MS driven by improving market conditions in China

- Last night’s GDT results show whole milk powder up marginally at 0.6% and skim milk powder down 0.5% with prices overall down 0.7

- Butter was the down 4.9% as well as anhydrous milk fat 2.8% in last night’s GDT auction