Protein Markets

- Argentine strikes still ongoing; now 12 days in, with no clear view when the issues will be resolved.

- Soybean futures extended a rally to the costliest since 2014 as Argentine strikes and dry South American weather amplified global-supply concerns.

- Soybean and oil exports estimated at around only 20% of December commitments due to ongoing strike disruptions.

- 111 vessels are currently waiting for cargo in Argentina.

- Improving forecasts through large areas of Brazil increase crop prospects for soybeans.

- DDG prices push higher on strengthening corn values and firmer protein complex.

PKE Markets

- Palm Oil prices slipped from recent highs on weaker petroleum.

- Anticipation of the Malaysian PO tax exemptions being revoked next year, Malaysia introduced this duty exemption on CPO, PKO, and processed palm products in June’20 to boost exports amidst the Covid-19 slump. It gave Malaysian CPO a competitive price advantage over rival Indonesian origin, but eroded refiners’ margins. The exemptions are scheduled to end in December, and Malaysian officials have made no indication that they would extend it into next year.

Grains Markets

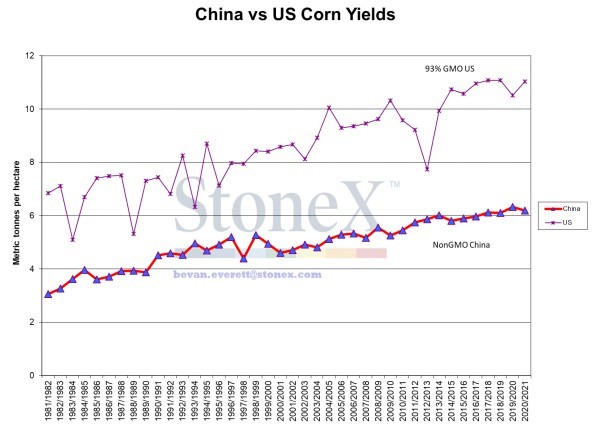

- China imported 1.14MMT of corn in the first month of the quarter, the second-highest level on record. This increase came from next to nothing-in October last year and was the third consecutive month above the one million tonne level.

- Some analysts are forecasting Chinese imports of US corn will hit the top end of market expectations next year and will exceed 50MMT by 2023 as we have now seen a structural shift in demand.

- Chinese yields continue to track behind other origins; revised farming practise or introduction of GMO’s could transform output rapidly.

- Russia will export 37.5m tons of wheat during the 2020-21 season ending in June, down from earlier expectations for 40m tons.

- Most private estimates of Australian crop have now crept over 33.5MMT with some forecasts now suggesting this is now the largest wheat crop ever (36MMT+).

- Ukraine has announced they will not place any bans on exports this season.

- AIMI (Arable Industry Marketing Initiative) had NZ maize grain crop down 7% and maize silage down 1% this season.

Currency / Political

- NZD/USD continues to hold just under 0.71

- Global covid cases continue to hit new highs as lockdowns and travel bans increase again through UK / Europe and the US.

- The US has agreed a $900bn stimulus bill although it will still need to pass congress.

- Dec WTI crude oil closed up 6.07% to finish at $49.24 a barrel. The market has rallied 34.65% since the end of October. It closed at its highest level since Feb 25th of this year. Pre pandemic.

Dairy Markets

- NZ MKP for 20/21 season currently sits at $7.04/kg/ms

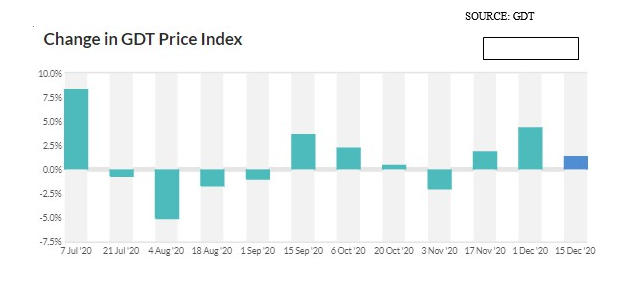

- Latest GDT result saw the third increase in a row continuing recent strength