Protein Markets

- US soybeans 97% planted vs 94% average; crop currently rated 60% good to excellent (G/E).

- Soybean markets awaiting next week’s acreage report as with a portion of the crop under severe drought markets is anticipating an increase in USDA planted area to offset.

- Canola markets remain hot as Canadian prairies miss recent weather systems across the US. Whilst markets have settled off their highs the Australian market still trading at over $700/mt.

- Egypt’s GASC (state buyer) purchased 80kmt of vegeoils.

- Parana River levels remain at critical level, impeding exports of beans and meal from Paraguay/Southern Brazil/Northern Argentina.

PKE Markets

- Indonesia who accounts for more than half of the world’s palm production is forecasting a 10% increase in Palm Oil exports this year as soaring prices and better crop prospects improve the countries trade surplus.

- Mystery creek field days were last week, signalling the biggest week of the year for Palm kernel sales in NZ. Despite contract prices being at the highest field days levels, there was still significant uptake as farmers had left themselves short leading into the event.

Grains Markets

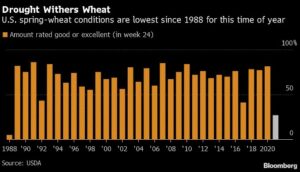

- US winter wheat crop has the worst G/E rating since 1988 due to drought.

- US corn crop rated 65% G/E vs 68% last report. Whilst still not too bad the states deteriorating are go

ing backwards fast.

- Algerian wheat crop only yielding 1.17mt/hectare driving increased imports throughout the region.

- Australia said to have sold another 250kmt of wheat to China for Aug-Sept shipment. Season to data is tracking around 1.7MMT.

- September wheat and corn futures down 20c and 52.2c respectively last week.

- South Island old crop wheat and barley remains extremely difficult to buy with many cropping farmers now happy to wait until spring to sell. Parcels that are trading are approximately $40/mt over harvest pricing.

- North Island maize is the last stages. Recent torrential rainfall in parts of BOP and Gisborne has stalled the last

of the crop. Completion date now early July.

- South Island new seasons contracting had slowed however this week another market participant has ramped up buying interest. Values holding similar to last buying round.

Currency / Political / Economic / Other

- NZD/USD trading at 0.700 after falling as low as 0.693 last week post Fed data.

- US has held inflation view despite current data. Forecasts maintaining that 2% target still on track. (sounds similar to RBNZ)

- Global supply chains remain under significant pressure. At present container, bookings out of Australia are full until September and prices have increased significantly. In the bulk space, daily hire rates are more than double levels seen a year ago.

- Brent oil crude trading at the highest level since Octobe r2018 current over USD75/barrel.

Dairy Markets

- NZ MKP for 20/21 season currently $7.61/kg/ms.

- NZ MKP for 21/22 season currently $7.85/kg/ms.

- NZ MKP for 22/23 season currently $7.10/kg/ms.

- WMP futures have drifted lower the last week in line with other commodities.

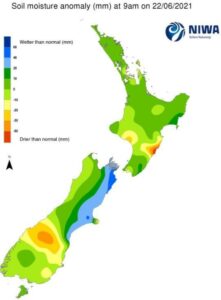

- Recent north island rainfall would have benefited soil moistures across most regions.

- Warm temperatures across much of the north island will continue to promote winter growth.

ing backwards fast.

ing backwards fast. of the crop. Completion date now early July.

of the crop. Completion date now early July.