Protein Markets

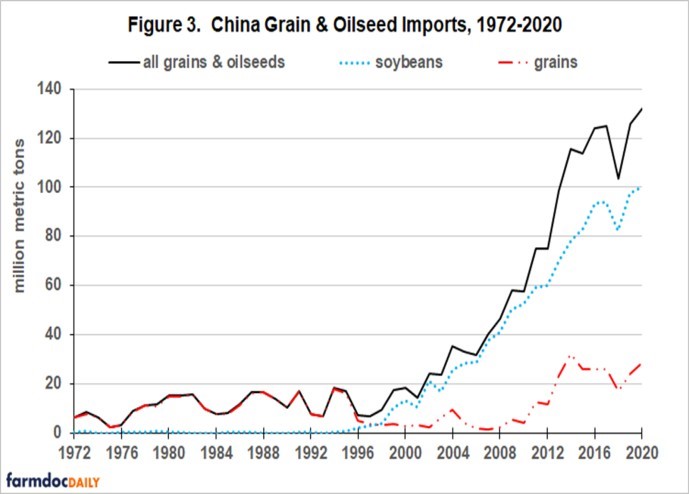

- Chinese demand continues to surge higher post the pig herd recovery and consumption of surplus stocks.

- Soybean markets gave up almost USD50/st in the last week as a better rainfall forecast and muted Chinese buying saw the market take a breather.

- Wet weather in Brazil is delaying the harvest of the early Soybean crop. With vessels already in the lineup, significant delays are expected through early Feb.

- DDG prices continue to rally with corn and the SBM/protein feed complex. Record cattle placed in feedlots in Dec20 continues to drive greater feed demand in US domestic markets.

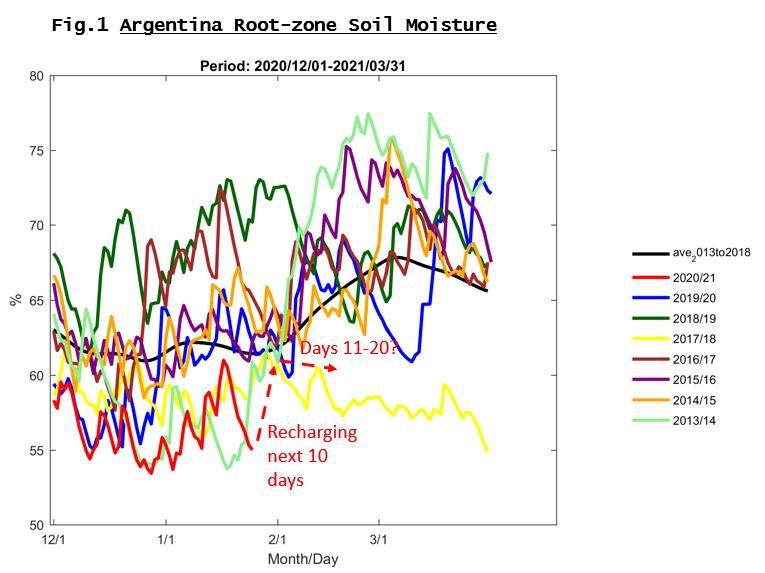

- Improved forecasts for the next 10days in Argentina has stabilized harvest prospects. However, soil moisture is still tracking well below norm (Fig 1), even if forecasts rains eventuate it will require a strong back end of the season to produce an average crop.

PKE Markets

- Export taxes and Levy on CPO likely to rise another 15% due to higher index price in Jan21.

- Palm oil plantations in Sabah are planning a voluntary lockdown on estates for the next 30 days following a spike in virus cases. Plantations will be allowed to operate,but with strict standard operating procedures and Covid-19 testing on all personnel and workers during the lockdown period

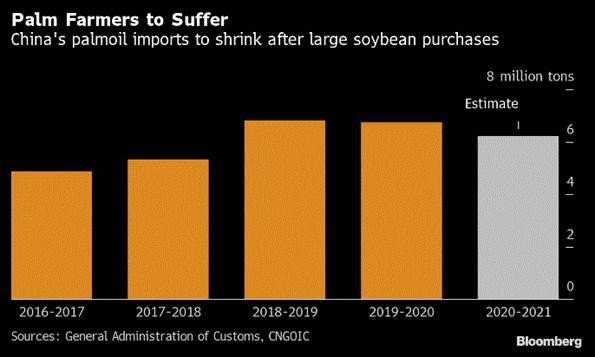

- Chinese palm oil demand set to hit 3-year low due to Bull Run as China made significant Soy oil purchases.

Grains Markets

- Agroconsult called Brazilian new crop corn production at 109Mmt, with their Safrinha estimate at 83.9Mmt.

- Despite unchanged fundamentals, at the exception of a better climatic situation in South America, grain prices tumbled last Friday.

- Australian growers estimated to be 65%-70% sold for the current season.

- Australian elevation capacity continues to extract premiums from market as demand continues to outstrip supply.

- Corn and Wheat markets bounce back after taking a brief reprieve with limit down movements at the back end of last week. Despite this physical markets resisted moves with them and futures are now back within 5-10c of previous highs.

- Ideal growth conditions persist across most of the north island continuing to increase prospects for a strong domestic maize crop.

- South Island harvest continues to make good progress with a large portion of autumn barley now in the bin; yields to date are trending average. Some early wheat has also been harvested with the bulk of harvest coming on in the next 2-3 weeks.

Currency / Political

- NZD/USD currently trading at 0.719.

- WHO expresses concerns around new covid variants and timeframe taken to roll out the vaccine to effective levels.

Dairy Markets

- NZ MKP for 20/21 season currently $7.21/kg/ms with 21/22 also up to $7.00/kg/ms as forward.

- NZX currently forecasting milk payout at $7.53/kg/ms

- The national PGI (Pasture Growth Index) remains in the upper range as the wetter than normal summer conditions remain across most regions.