Protein Markets

- New crop Brazilian soybeans have been forecast up by 1.3MMT to 130.8MMT with overall planted area at 38.2M hectares

- The Illinois River has been effectively shut for repairs on damns and locks until October where an estimated 40MMT of coal, fuel and farm goods including corn and soybeans is transited

- Argentina crushed 3.64MMT of soybeans June 2020 compared to 4.6MMT in June of 2019 with the first half year crush now at 19MMT down 15% on last year

- Two soybean crushing plants in Argentina have been forced to close for a week with fresh outbreaks of Covid-19

- Chinese data shows a record import of 11.2MMT of soybeans in June as the country continues stockpiling but US export pace to China remains below Phase 1 Trade War commitments

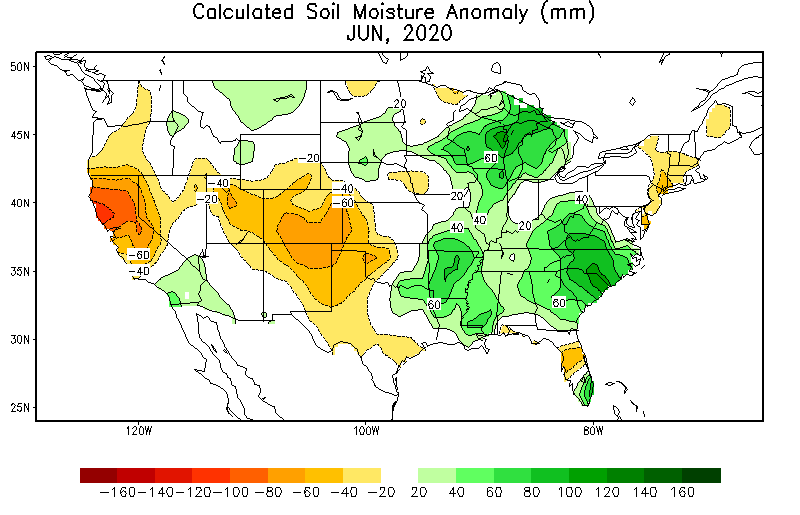

- Weather across the US is cited as near ideal for soybean podding, a key stage for final yields with beans now at 43% podding vs 36% on average

- US soybean conditions improved this week rated at 72% good to excellent vs 69% last week with an extended run of ideal weather

PKE Markets

- The Council of Palm Oil Producing Countries (CPOPC) has estimated a 3-5% reduction in output of palm production in 2020 between Indonesia and Malaysia

- Indonesian state owned palm refinery is trialling production of jet fuel made of up to 3% palm oil in a bid to boost demand and maintain biofuel targets

Grains Markets

- Brazilian second crop corn harvest is nearing 56% right in line with the average but well down on last year at 71%

- US Winter wheat is now 81% complete vs 73% last week with the majority of hard and soft red wheat complete and only white wheat left in the Western side of the wheat belt

- Hot and dry weather across France has private analysts calling the wheat crop at 29.22MMT with area down 14% making it one of the smallest crops expected in over 25 years

- A spike of over 40,000 new Covid-19 cases in Russia last week, many of which in agricultural areas has sparked concerns for a drawn out wheat harvest expected to be the largest on record

- Southern Western Australia has missed much of the rainfall in the past week with isolated areas receiving record low rainfall

- Domestic grain contracting remains slow across both North and South Island with a large spread between bid and offers

Currency

- The New Zealand Dollar opened stronger again this week testing 67 US cents as the US economy struggles with the ongoing pandemic recovery

- The US is bracing for the domestic economy to contract an unprecedented amount up to 35% in the second quarter following a 5% contraction in the first quarter

- China’s economy is recovering quicker than expected in the wake of the Covid-19 spread at 3.2% Q2 year on year after Q1 fell 6.8% year on year

- The New Zealand Government has announced it has set assize $14 billion NZD from the COVID Response and Recovery fund as an emergency for a second wave Covid-19

Dairy Markets

- ANZ has revised its milk price forecast up 75c to $6.50 for the 2020/21 season with ASB increasing by 25c to $6.75 both within Fonterra’s current forecast of $5.40-$6.90/kg ms

- Last week’s GDT auction had an increase of activity by 14% Northern Asia (predominately China) accounting for 60% of activity while Southern Asia and Middle east were down 21% and 43% respectively