Protein Markets

- US soybean harvest is nearing completion at 87% vs 83% with fields to be mostly completed in the next two weeks with dry weather on the forecast

- US soybean acres are set to expand next year to 89 million acres up from current estimate of 83.1 million as tight global supplies will likely provide incentives to farmers to switch acres

- Workers at Argentina’s soybean crush plants are expected to strike for another 24 hours over pay disputes despite a one off bonus offered of 11,000 pesos (approximately $140 USD)

- Rains have missed both Brazil and Argentina’s soybean belts last week with crops looking for more rainfall or face further downgrades in production estimates

- Brazil soybeans are 42% complete planted vs 44% on average with Mato Grosso well behind a t54% vs 68% average

- Labour shortages due to the ongoing pandemic are causing a delay of 10-15 days for vessels transiting through the Panama Canal

- US ethanol and DDGS production reached a 10 week high last week but still remains 6.3% lower than the same week last year

- Barge and rail logistics are beginning to tighten through the Gulf and Midwest with a full export pipeline expected now that China is executing sales under the Trade War Phase 1 deal

PKE Markets

- Indonesia is highly anticipated to lift the export levy on palm products to follow progressively escalating levy similar to that already in place in Malaysia

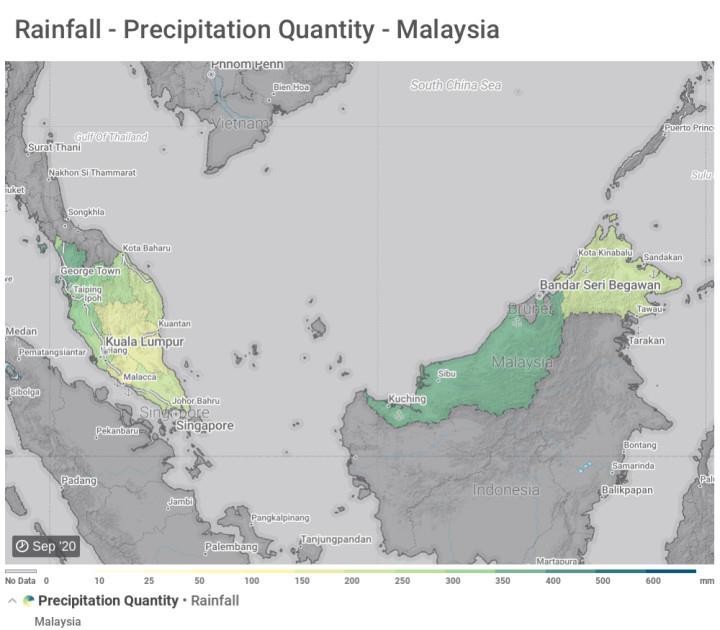

- The La Nina event forecast has strengthened to a be considered a “strong La Nina” with above average rainfall already seen in early Spring through South East Asia

Source: GroIntelligence

Grains Markets

- US corn harvest is now 82% complete vs 72% last week with dry weather aiding progress in fields

- Argentina’s corn planting has progressed to 30% complete vs 40% this time last year with ratings at 91% fair to excellent vs 94% this time last year

- The French Maize crop is now 80% harvested vs 60% this time last year, approximately 9 days ahead of the average

- China is rumoured to have bought US ethanol for the first time in over 12 months after escalating trade tensions saw a 70% import tariff on US ethanol

- The Argentine wheat harvest has just started at 6% complete with production estimated at 16.8MMT unchanged from last month’s estimates

- Argentine wheat ratings are 59% fair to excellent vs 50% last week aided by much needed showers but frost events over the weekend left the door open for a decrease in conditions

- China has rejected an Australian appeal to the recently enacted 80.5% barley tariff with production expected to tip 10MMT

- US Winter wheat conditions have improved to 43% good to excellent vs 41% last week

- Temperatures are expected to reach the early 30’s this week in South Australia with harvest starting to ramp up at 2-3% complete

- Nearly 30mm of timely rainfall was received across Southern Canterbury in the last two weeks boosting prospects of the grains harvest but still more rainfall is required to satisfy growers

Currency

- The NZD opened the week at 66.1 US cents down from last week with general worldwide economic weakness as more than half a million Vocid-19 cases were reported in a single day

- OECD reporting in foreign investment fell sharply in the first half of 2020, down by 50% to the lowest level since 2013 including a 60% decline for New Zealand

- British Prime Minister Boris Johnson has ordered another nationwide lockdown for 4 weeks with warnings the health care system will be unable to cope with demand within weeks

- US President Donald Trump has announced that no additional stimulus will be announced prior to the election to take place this week

Dairy Markets

- Dairy NZ has estimated 800 job vacancies still exist in the dairy industry across New Zealand putting pressure on farms during the past months busy with calving

- Fonterra has entered a deal for New Zealand products to be sold nationwide in the US with Land O’ Lakes including cream cheese and UHT cream

- Last nights GDT results have prices down 2.0% overall with losses to milk powder (2.0%), skim milk powder (4.4%) and cheese (0.8%) and a gain to butter (3.9%)