Protein Markets

- US ethanol/DDGS production rose in May according to official US figures at 147 million gallons in May vs 144 in April

- US ethanol production figures also show a significant increase in the use of soy oil for ethanol/biodiesel at 70% in May vs 57% in February

- US soybean yields are being talked up to highest on record with crop conditions now at 73% good to excellent up 1% from last week and setting pods at 59% vs 43% last week

- China has bought more than $2.5 billion USD worth of US soybeans in just eight weeks however still well short of commitments with a 91% increase of purchases from Brazil

- The Indian Farm Ministry announced oilseed plantings were up 2.5m hectares from last year at 15m hectares including 11.7m hectares of soybeans

- Two soy crush plants in Argentina have resumed normal operations after positive Coronavirus cases confirmed last week

- Brazil is estimated as the world’s largest soybean producer in the 2019/2020 season with a 126MMT crop after a poor US season at an estimated 96.68MMT

PKE Markets

- Indonesia plans to continue increasing the biofuel mandate from 30% to 40% by July 2021 largely produced from palm oil

- Southern Peninsular Malaysia production was down 9.52% with yields down 10.32% for crude palm oil with a similar amount expected for PKE

Grains Markets

- The Argentine corn harvest is now practically finished at 97% complete with production expected to reach 50MMT

- Argentina’s wheat crop is now 96% complete planted but frosts have stressed come crops in central Argentina

- Brazilian second crop corn are 54% harvested vs 74% a year ago as dry weather and late plantings delay crop development

- French maize has been revised down to 77% good to excellent vs 80% last week with high temperatures stressing crops

- Torrential rains in June and July have significantly delayed the Chinese corn harvest and rumours are circulating reserves are being squeezed with an estimated 25-40MMT deficit in imports

- Despite average rainfall YTD South Australia wheat and barley yields have been revised down as crops need a top up of moisture after below average rainfall in July

- The Latest AIMI report shows overall production was up 10% with yields up 17% and area down 6%

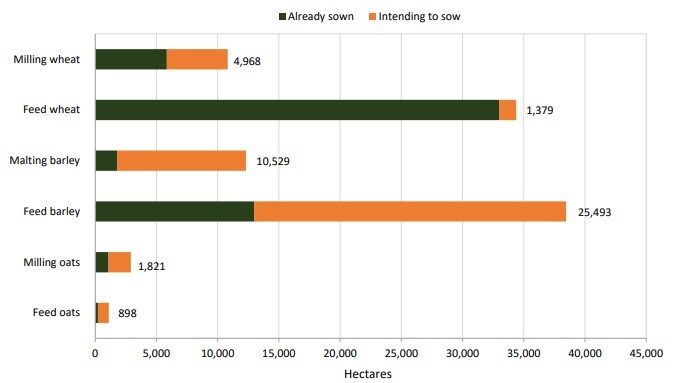

- AIMI also reported Autumn/Winter sowing conditions were very good in most regions with sowing intentions similar to last year with the exception of malting barley down 10% and a swing to milling oats up 32% over feed down 14%

NZ Plantings & Intentions as at 1 July – Source: AIMI July Report

Currency

- The New Zealand Dollar opened lower this week at 66.3 US cents after testing 67 US cents last week but ultimately falling short after cautiously optimistic comments from RBNZ policy makers

- US President Donald Trump has hinted toward long-term shutdowns are possible if infection numbers don’t trend downwards

- ANZ Bank has warned of a double-dip recession with stalling business confidence, border controls hit seasonal tourism and an end to mortgage holidays and wage subsidies

Dairy Markets

- Last night’s GDT results show an overall drop in prices by 5.1%, a whopping 7.5% to whole milk powder and a 4.6% loss to skim milk powder

- Rabobank has warned that demand for dairy in China appeared strong in the first half of 2020 but reflected a change in business attitude of carrying more stock for food security during the pandemic