Protein Markets

- Argentina’s names new trade minister who extends Parana River dredging agreement by 90days to all

ow continued export flow.

- US soybean planting 24% done vs 11% average as the large crop states of Iowa and Illinois were both over 40% seeded.

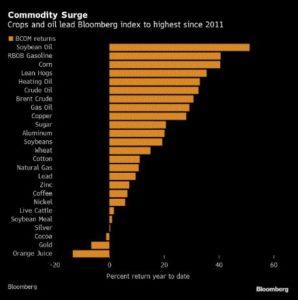

- Commodities surge to highest levels seen since 2011, led by soybean oil as the largest return year to date.

- Brazil soybean exports expected to dip after April’s record of 17.4MMT.

- Argentina exported 253,000MT of soybeans in April.

- DDGS production has bounced back up 9% YOY.

PKE Markets

- Indonesia’s palm oil output forecast to rise 7% to 55.69MMT this year on improved weather with rainfall forecast to be normal/above normal.

- Showers to maintain favorable conditions for palm in SE Asia. Rains forecast above normal across the region over the next 10 days, which will maintain favorable moisture for palm and ease the dryness in Java and southeastern Kalimantan.

- Intertek Testing Services showed Malaysian palm oil exports rose 10% in April from a month earlier, thanks to bigger purchases by top importers India and China

Grains Markets

- US corn planting now 46% complete a 29% increase week on week and fastest week of planting in over 6years.

- US March corn exports up 105% YoY.

- Argentine wheat/barley farmers forecast to harvest an additional 12% this year up to 19MMT and 4.6MMT respectively.

- Safrina crop region remains very dry further jeopardizing crop prospects.

- NZ maize harvest continues to accelerate, at current rates harvest is expected to complete early.

- NZ AIMI report due out this week, updating estimated crop size this harvest and forecasting autumn sown tonnage.

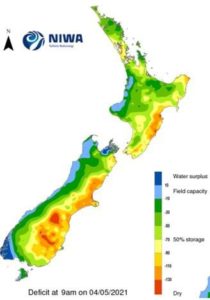

- Canterbury farmers have continued sowing autumn crops despite the dry conditions. While most farms have enough moisture for emergence, winter rainfall will be essential to replenish soil moisture and aquifers.

- The first 2022 milling wheat contracts have been released, tier two milling wheats currently bid lower then forward feed prices.

Currency / Political

- NZD/USD currently trading at 0.714 off yesterday’s highs.

- NZ unemployment data was stronger than expected as unemployment levels fell to 4.7%

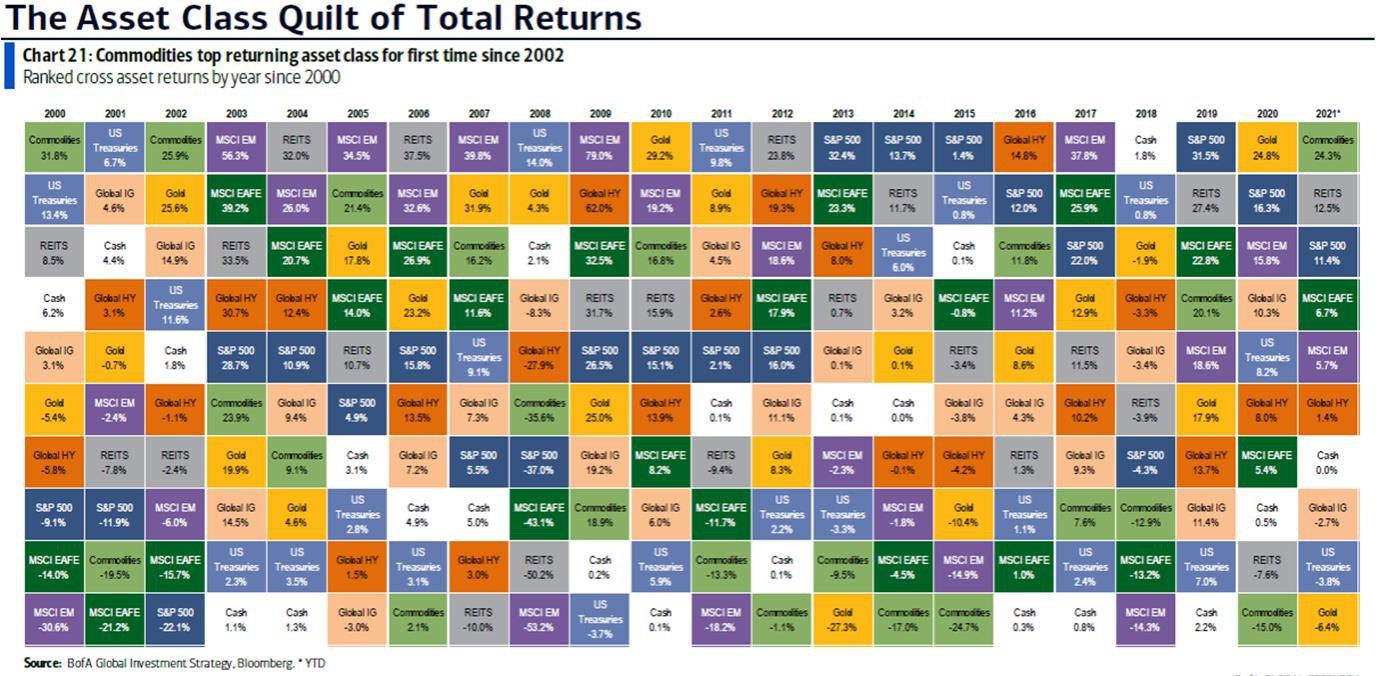

- Commodities the top performing asset class so far of 2021

ow continued export flow.

ow continued export flow.