Protein Markets

- US soybeans are down 1% in conditions to 65% good to excellent from last week with yields forecasted at 53.3 bpa up 3.5 bpa from July despite the downgrade in conditions

- China imported the largest ever volume of soybeans in August estimated at 9.6MMT with total imports for 2019/2020 expected to be 98MMT

- China has now booked 20.5MMT of US soybeans for 2020/2021 and is on track to meet phase 1 trade war obligations of 26-28MMT

- New crop Brazilian soy production is estimated at 131.4MMT vs 130.8MMT previous estimate in July with expanded planting areas and record anticipated record yields

- Rain over Central Argentina have eased concerns for dry sunflower seeding with plantings now estimated at 10% complete

- Exports of DDGS in July from the USA were 1.08MMT up 23% from June and up 30% from a year ago

- After weeks of talks Brazil has agreed to a temporary 90 day extension of the tariff free imports of US ethanol with exports of both ethanol and DDGS down around 9% year on year

PKE Markets

- August production of Palm oil in Malaysia is up 3.79% from July slightly ahead of the same time last year but poor oil yields are likely to mean PKE production up slightly more

- Indian palm oil imports have dropped for August by 11% which has put burnden back onto stocks in both Indonesia and Malaysia likely to restrict crushers ability to process fruit

Grains Markets

- US corn conditions are 61% good to excellent down 1% from last with dryness through Iowa now expected to prevent a record corn crop predicted early last month

- US corn yields continue to decline to an estimated 178.1 bpa vs 179 bpa last month as farmers continue to assess the damage from the storm event

- French maize has been downgraded to 61% good to excellent vs 62% last week after hot and dry weather through August takes its toll

- It has been estimated that up to 40% of US farm income this year will be from Government subsidies including prevented plantings and Trade War facilitation payments

- US spring wheat is now 85% harvested with slightly reduced yields pushing up protein levels to 14.6% vs an average of 14.4%

- Rains over Central Argentina have brought relief to the wheat crop however ratings have slid to 59% fair to excellent down from last week at 62% at estimates falling to sub 19MMT

- The Russian wheat crop has further expanded to an estimate of 82.6MMT up 1.4MMT from estimates last month with near ideal growing across the country

- Favorable winter conditions has increased the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) production forecast for wheat up 8.4% from June estimates to 28.91MMT

- Domestic maize is scarce across the North Island with ownership all at the local mill level until new season is available with consumers looking for substitutes

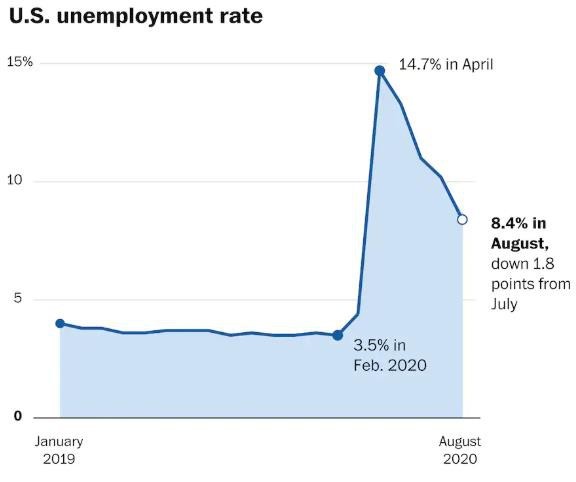

Source: Washington Post

Dairy Markets

- RaboBank has released it’s annual Global Dairy Top 20 – a list of highest companies with the grossing dairy sales topped by Nestle and Fonterra has slipped 2 places to 6th

- Fonterra has announced it is maintaining its current milk price forecast of $5.90-$6.90/kgMS after a review last Wednesday despite a slip in dairy prices at last week’s GDT

- Fonterra is expected to release its final milk payout for the 2019/2020 season next Friday the 18th currently sitting at $7.10-$7.20/kgMS as part of its annual result

- Westpac has also maintained its current milk price forecast at $6.50/kgMS for 2020/2021 noting the worst impacts of Covid are largely over for the dairy industry