Protein Markets

- Argentina, the world’s top soybean-oil exporter has avoided shipping quotas and higher taxes on soybean oil, the oilseed processors plan to spend $190 million over the next year to subsidize local cooking-oil prices.

- Drier weather over the past several days has allowed some minor dryness to develop in southern growing areas in Argentina ,potentially leading to some minor crop stress. Mostly dry weather is expected in Argentina over the next few days, with only a few light showers expected in eastern areas late this week. Below normal rainfall is expected to continue during the 6-15 day period, which will lead to increased dryness, and potentially stressing soybeans.

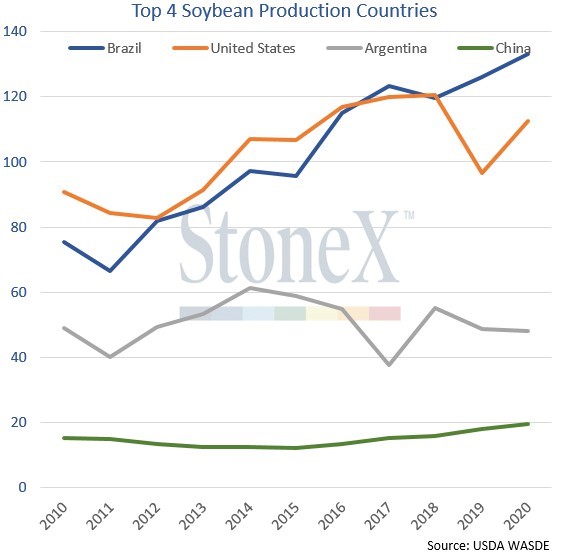

- WASDE world soybean carryout was reduced from 84.3MMT last month to 83.4MMT this month vs avg trade guess of 83.3MMT.

- Brazil continues to extend its position as the world’s largest soybean producer with 135MMT.

PKE Markets

- Malaysia BMD futures retraced heavily early last week reacting to India’s hiked palm duty, recovering towards end of the week. Spot and nearby price squeeze continued as Feb and Mar gained a larger premiums over deferred due to short nearby stocks.

- China market almost at a standstill due to the lead up to Chinese New Year. Most Chinese companies will close beginning tomorrow 10-Feb and will not reopen until 22- Feb for the golden week.

Grains Markets

- Australian grain export capacity remains well booked out to the middle of the year, as demand remains high from all regions.

- The snows continued to boost the snowpack across the Black Sea region and protect wheat from subzero temperatures across northern Ukraine.

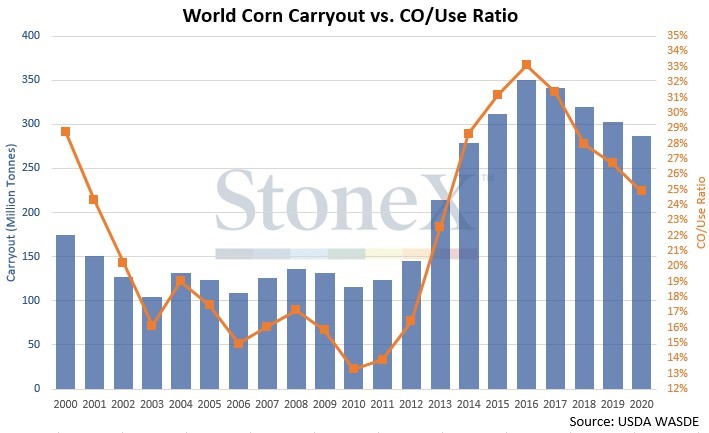

- Last night’s WASDE report came up with a few surprises, US corn ending stocks were 1.502bln bushels vs average trade guess of 1.392 bln bushels.

- WASDE world corn carryout came in higher than expected at 286.5MMT, despite this it would still be the lowest carryout in 6years from a tonnage perspective and the lowest CO/use ratio in 7years.

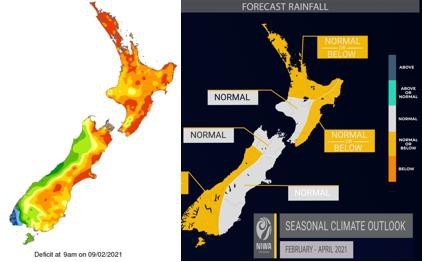

- South island cereal harvest pace remains slower due to scattered rain and slower maturing crops than anticipated. Yields so far tracking average through mid- Canterbury and slightly below in South Canterbury.

- North island conditions have been predominantly dry placing some stress on maize crops. Whilst the average condition is still good, rainfall is required across all regions to maintain yield potential. Rainfall forecast across many regions later today.

Currency / Political

- NZD/USD off recent highs currently trading at 0.723.

- Brent Oil went past $60, the highest it has been since the start of the pandemic last year.

- Continued production cuts from the OPEC+ group and the extra cut from Saudi Arabia, supported oil prices at the start of last week.

- The tightening of the oil supply, inventory drawdowns, combined with prospects of a rise in demand later this year with COVID-19 cases now falling and vaccination rates increasing has been boosting oil prices since the start of February.

- An expected stimulus package from the Biden administration also helped propel the push higher, with expectations that the stimulus will increase employment, further improving demand outlook.

Dairy Markets

- NZ MKP for 20/21 season currently $7.07/kg/ms.

- Fonterra increased its forecast range for the Farm-gate Milk Price for the 2020/21 season, with the mid-point of the range increasing from $7-$7.2/kg. The milk price is upped $6.7-$7.3 per kg to $6.9-$7.5.

- The forecast earnings per share held at 20-35cents. Strong Chinese and South East Asian interest have driven demand.

- Most recent GDT result up 1.8%, WMP the main driver for NZ farm gate price climbed 2.2%.

- Many parts of NZ turning dry with lack of substantial rainfall for many regions. Forecast for remainder of season for below-normal rainfall